Covid-19 Grant Payments – What Do You Need to Declare on Tax Return?

Covid-19 grant payments must be declared on the 20/21 tax return & HMRC is reminding SA customers about the same during this tax return season.

Covid-19 grant payments must be declared on the 20/21 tax return & HMRC is reminding SA customers about the same during this tax return season.

As the pandemic has changed the way that many of us work, there is an impact on the benefits and staff support that employers provide.

SEISS 5th Grant covering May 2021 to September 2021 will be open to claims from late July 2021. Learn how to claim it!

How to claim 4th self-employed grant – next SEISS payment explained, and when you can apply with HMRC.

Recovery Loan Scheme opened for applications on 6 April 2021 and is available to businesses affected by the pandemic. Find out how to apply.

At the Budget, it was confirmed that the fourth SEISS grant will be set at 80% of 3 months’ average trading profits.

Budget 2021: Key points at-a-glance. The Chancellor of the Exchequer presented his Budget to Parliament on Wednesday 3 March 2021.

5 January 2021: Chancellor Rishi Sunak has announced £4.6 billion in new lockdown grants to help businesses through the latest national lockdown.

Coronavirus Job Retention Scheme (CJRS) extension: Chancellor Rishi Sunak has extended the furlough scheme for one month until the end of April 2021.

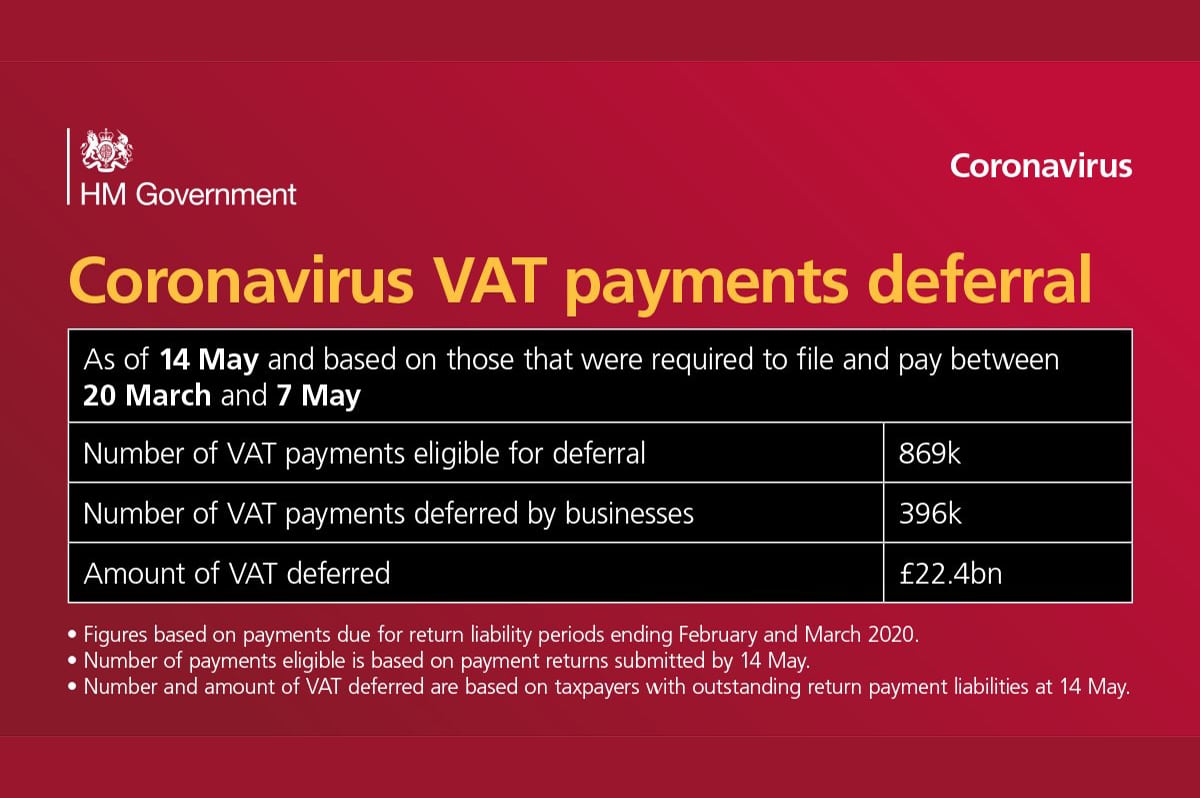

Businesses which deferred VAT due in March to June 2020, have the option to spread their payments over the financial year 2021/2022. How to apply.

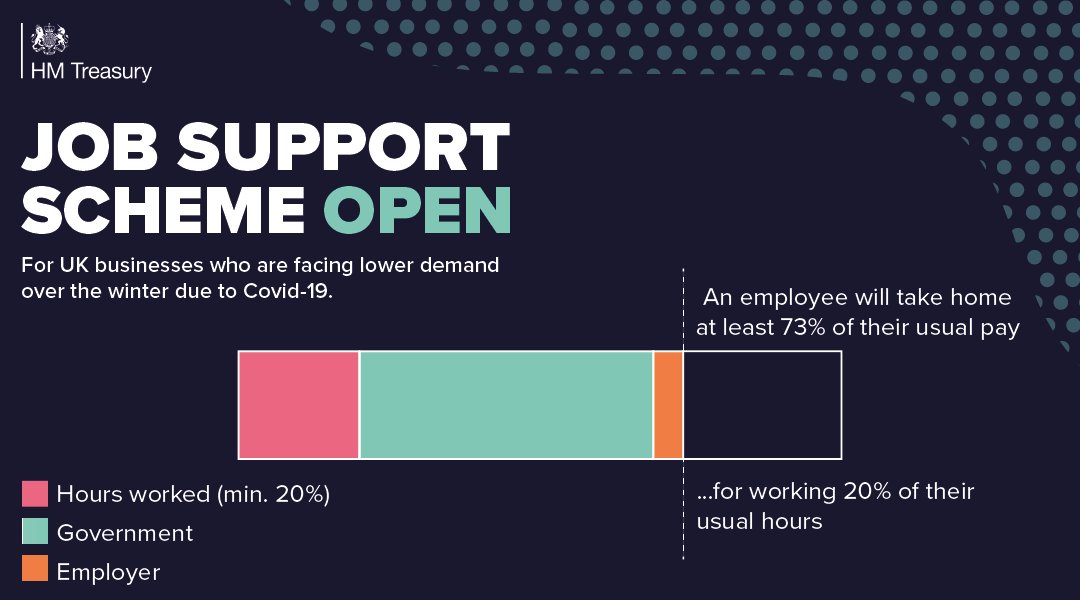

JSS Open & JSS Closed (1st November 2020): Eligibility criteria, conditions and timescales for making claims under the Job Support Scheme.

Find out if you’re eligible to claim the Job Retention Bonus and what you need to do to claim it between 15 February 2021 and 31 March 2021.

[wpzoom_social_icons id=”7980″]

Have a query or need guidance?