Covid-19 Grant Payments – What Do You Need to Declare on Tax Return?

24/12/2021 - 6 minutes readCovid-19 grant payments must be declared on the 2020/21 tax return & HMRC is reminding self-assessment customers about the same during this tax return season. Covid-19 grant payments include SEISS claims which are taxable based on the payment date.

More than 2.7 million customers claimed at least one Self-Employment Income Support Scheme (SEISS) payment up to 5 April 2021. These Covid-19 grant payments are taxable and customers should declare them on their 2020 to 2021 tax return before the deadline on 31 January 2022.

The SEISS application and payment windows during the 2020 to 2021 tax year were:

- – SEISS 1: 13 May 2020 to 13 July 2020

- – SEISS 2: 17 August 2020 to 19 October 2020

- – SEISS 3: 29 November 2020 to 29 January 2021

SEISS are not the only Covid-19 grant payments that customers should declare on their tax return. If customers received other support payments during COVID-19, they may need to report this on their tax return if they are:

- – self-employed

- – in a partnership

- – a business

Information on which Covid-19 grant payments need to be reported to HMRC and any that do not is available on GOV.UK.

It is important that customers check and make any changes to their tax return to make sure any SEISS or other Covid-19 grant payments have been reported correctly in their Self Assessment.

What do you need to declare on your Tax Return?

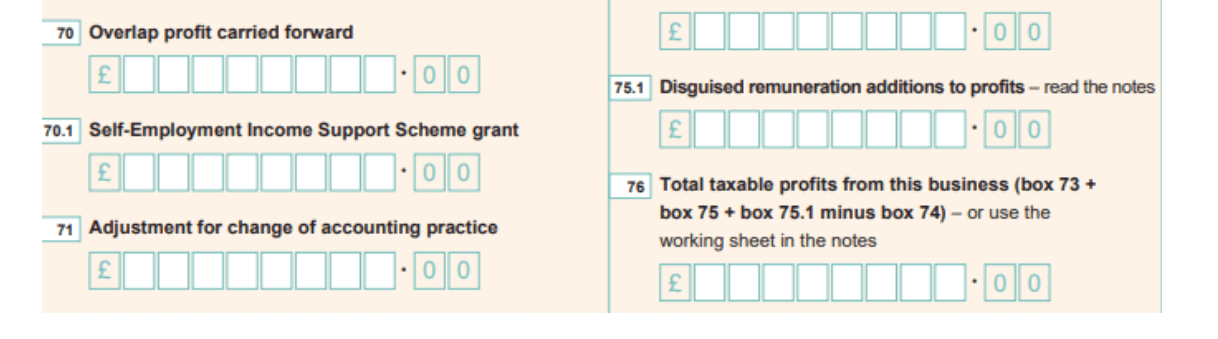

If you claimed Self-Employment Income Support Scheme (SEISS) or received Coronavirus Job Retention Scheme grants, you’ll need to include details of all the taxable Covid-19 grant payments you received during the 2020 to 2021 tax year.

If you are employed and received Coronavirus Job Retention Scheme (furlough) payments during the 2020 to 2021 tax year, you will need to enter your earnings and Income Tax as stated on your P60. Your P60 will include any furlough payments you received up to 5 April 2021, so you do not need to include furlough payments on your tax return.

If you are self-employed or in a partnership and received any coronavirus financial support, you will need to declare it on your Self Assessment.

If you are self-employed, you should use:

- – form SA103S – short if your tax affairs are simple and your turnover was below the VAT threshold (£85,000) for the tax year

- – form SA103F – full if your annual turnover was above the VAT threshold for the tax year

If you’re in a partnership, you should use:

- – form SA104S – short if you’re only declaring partnership trading income

- – form SA104F – full to record all the possible types of partnership income you might receive

Latest self-serve Time to Pay figures are for arrangements set up in the 2021 to 2022 tax year and are up to 28 November 2021.

Here we set out tips and advice on how to prepare your annual self-assessment return.

Annual self-assessment return tips & advice

Get online

If you are new to self-assessment, register with HMRC and give yourself a few weeks to complete the process. HMRC revealed that more than 10.7 million customers completed a tax return by 31 January 2021, of those 96% were submitted online.

If this is your first time completing an online tax return, you may be asked additional questions to prove your identity. To answer these questions, please have as many of the following to hand where relevant, when making your claim:

- – your UK passport

- – Northern Ireland (DVA – issued) driving licence

- – information held on your credit file (such as loans, credit cards or mortgages)

- – your Self Assessment tax return (within the last three years)

- – your tax credit claim

- – your P60

- – one of your three most recent payslips

Gather your files

Gather all your relevant information before you can file your tax return. Depending on your circumstances, this could include proof of self-employed income, a P60, P45 or a P11D.

As a basic rule, you’ll need to show any money received or earned from pretty much anywhere – including wages from a job, income from a trust, and interest from your bank account (except an ISA). If you’re a limited company shareholder, you’ll also need to provide proof of any dividends received during the tax year.

You don’t want to be gathering this paperwork at the last minute, so make sure this is all in order ahead of time.

Use resources online and get professional advice if you need to

Make sure to consult HMRC’s website or get help from a professional accountant or tax adviser to make sure you understand all of the regulations in place specific to your business.

How can MCL Accountants help?

Contact MCL Accountants on 01702 593 029 if you have any queries on the Covid-19 grant payments that must be included on tax returns or if you need any assistance with the preparation and submission of your business accounts or self-assessment tax returns to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments