Worldwide Disclosure Facility (WDF): How to Settle Undisclosed Offshore Income, Gains or Assets

Learn how to use the Worldwide Disclosure Facility (WDF) to disclose a UK tax liability that relates wholly or in part to an offshore issue.

Current tax tips and client-focused news, alongside a complete, searchable archive of past updates.

Learn how to use the Worldwide Disclosure Facility (WDF) to disclose a UK tax liability that relates wholly or in part to an offshore issue.

From 1 January 2021 goods arriving into the UK from the EU will be imports and goods sent from the UK to the EU will be exports in VAT terms.

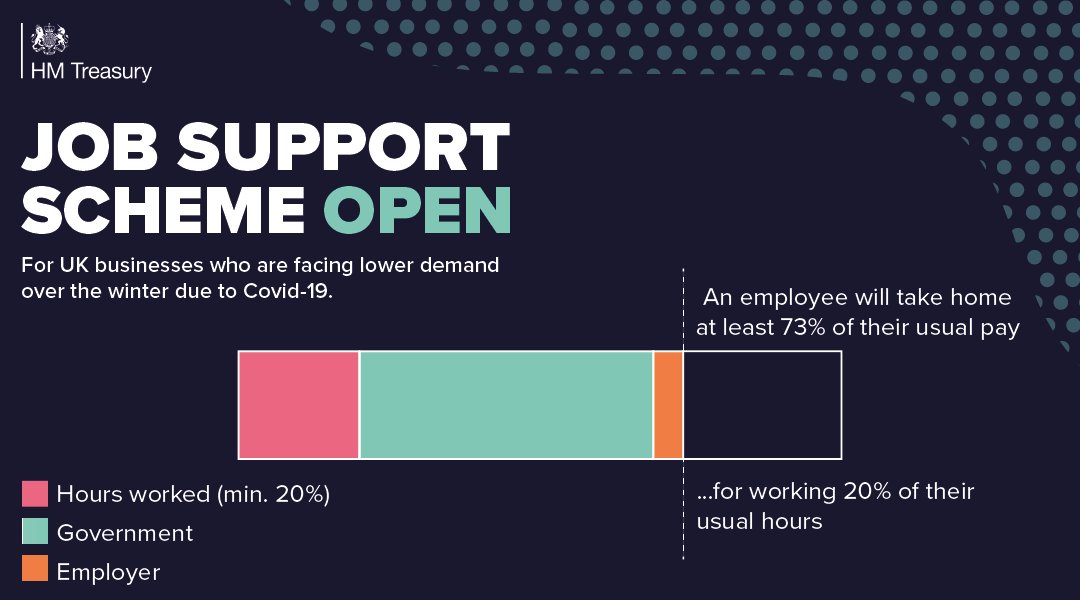

JSS Open & JSS Closed (1st November 2020): Eligibility criteria, conditions and timescales for making claims under the Job Support Scheme.

If you rent out a property, you’ll need to pay tax on any profit you make. Learn how to work out your taxable rental profit and how to report it to HMRC.

Landlords should realise that HMRC will know about their lettings through Airbnb, so full disclosure of all their taxable property income is essential.

Find out if you’re eligible to claim the Job Retention Bonus and what you need to do to claim it between 15 February 2021 and 31 March 2021.

From business rates to VAT relief, we’ve pulled together 10 tax reliefs small businesses can claim to help you work out if you can reduce your tax bill.

Q. I’m now working from home since the outbreak of coronavirus (COVID 19), Can I submit a homeworking expenses claim? A. In short, the answer is yes but there are conditions that need to be met. I […]

Get closer to the intricacies of company loans. Can I lend money to my company? Most small companies start their trading activities by advancing funds via an informal ‘director’s loan’ that in most cases is […]

Got a Self Assessment tax return to fill in but not sure what your business can claim back? Understanding what your allowable expenses are, as HMRC calls them, can really help your business. This is […]

What are the tax implications for renting out your own property? The basic position is that income from renting out property is taxable. However, rent a room (RaR) relief allows you to earn up to […]

If you have a driveway, field or land that can be utilised for parking then you may well have an excellent opportunity to earn some income, TAX-FREE!

[wpzoom_social_icons id=”7980″]

Have a query or need guidance?