£20 million SME Brexit Support Fund Opens for Applications

The £20m SME Brexit Support Fund enables traders to access practical support, including training for new customs, rules of origin and VAT processes.

Up-to-date tax insights and strategies to support smarter planning all year round

The £20m SME Brexit Support Fund enables traders to access practical support, including training for new customs, rules of origin and VAT processes.

At the Budget, it was confirmed that the fourth SEISS grant will be set at 80% of 3 months’ average trading profits.

Budget 2021: Key points at-a-glance. The Chancellor of the Exchequer presented his Budget to Parliament on Wednesday 3 March 2021.

Have you received a letter from HMRC for income from letting a property? If yes, please contact us to discuss your options and how we can help you.

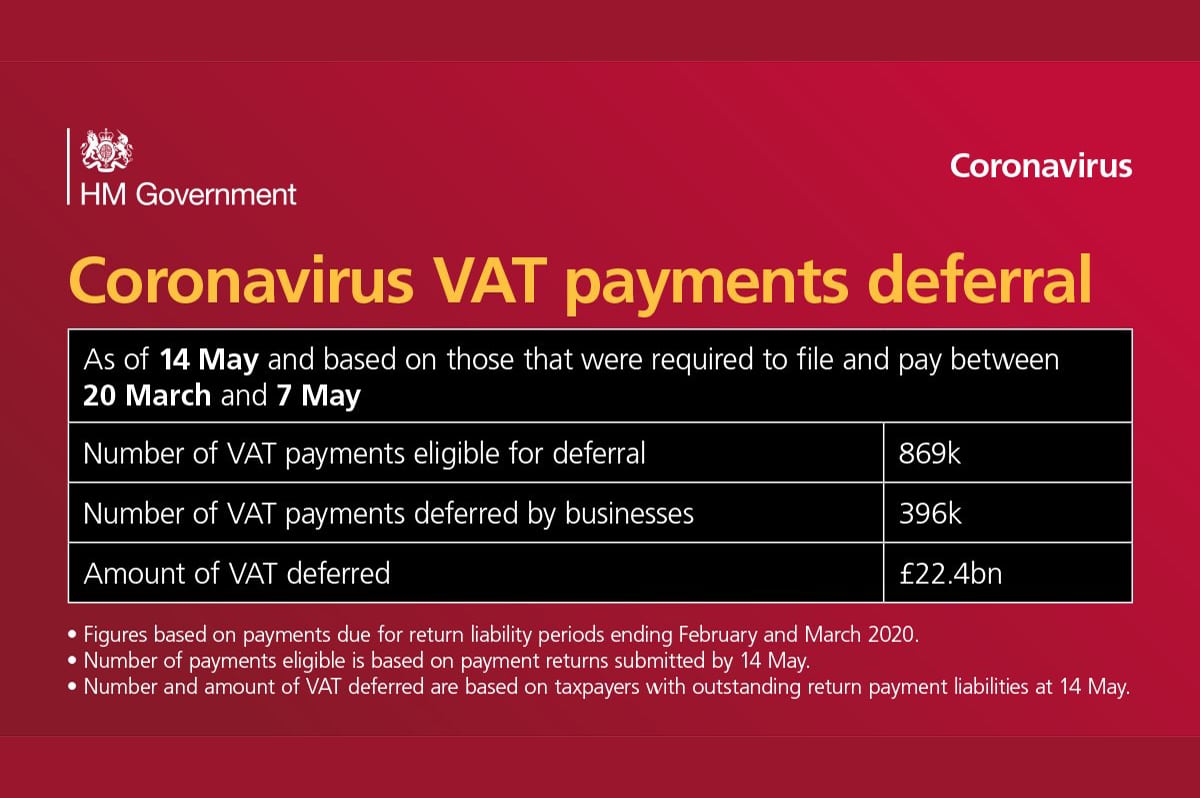

Instead of paying the full amount by the end of March 2021, up to 11 smaller monthly instalments can be made, interest-free. Learn how to join!

Capital Gains Tax is payable on the sale of second homes & buy-to-let properties. Find out how to report & pay CGT on the sale of rental property.

With the Brexit transition period over and a deal in place, there are a few changes you need to be aware of when sending goods from the UK to Europe.

Find out about the VAT Domestic Reverse Charge for supplies of building and construction services from 1 March 2021.

5 January 2021: Chancellor Rishi Sunak has announced £4.6 billion in new lockdown grants to help businesses through the latest national lockdown.

Coronavirus Job Retention Scheme (CJRS) extension: Chancellor Rishi Sunak has extended the furlough scheme for one month until the end of April 2021.

Businesses which deferred VAT due in March to June 2020, have the option to spread their payments over the financial year 2021/2022. How to apply.

Capital Gains Tax review may help landlords and second homeowners to cut their tax bills under new proposals for capital gains duties.

Learn how to use the Worldwide Disclosure Facility (WDF) to disclose a UK tax liability that relates wholly or in part to an offshore issue.

From 1 January 2021 goods arriving into the UK from the EU will be imports and goods sent from the UK to the EU will be exports in VAT terms.

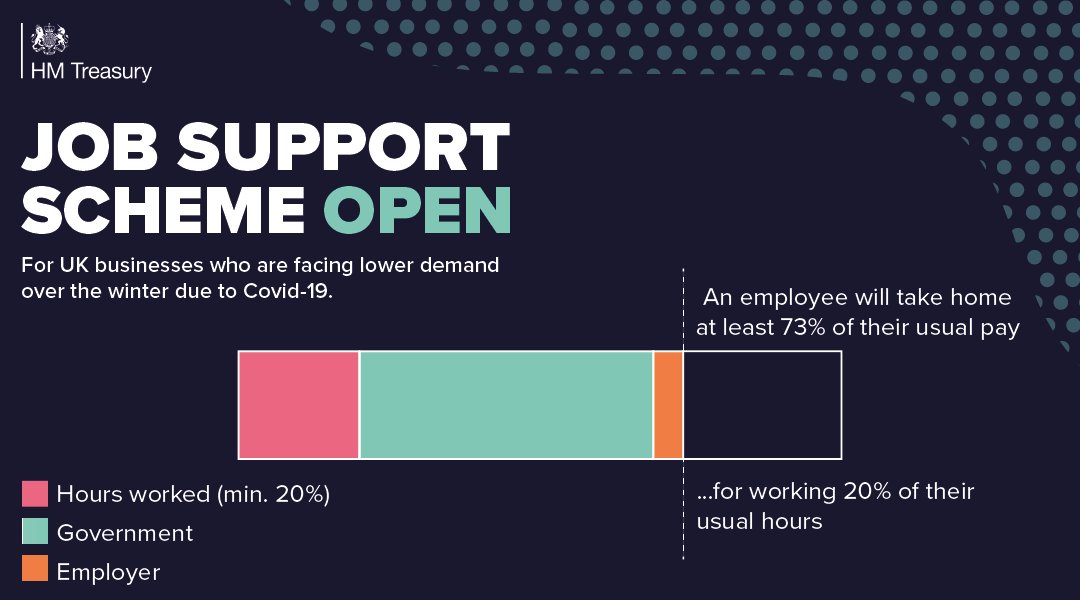

JSS Open & JSS Closed (1st November 2020): Eligibility criteria, conditions and timescales for making claims under the Job Support Scheme.

If you rent out a property, you’ll need to pay tax on any profit you make. Learn how to work out your taxable rental profit and how to report it to HMRC.

[wpzoom_social_icons id=”7980″]

Have a query or need guidance?