VAT Domestic Reverse Charge for Building and Construction Services

16/01/2021 - 6 minutes readDomestic Reverse Charge rules often cause confusion. In brief, the customer accounts for output tax in box 1 of their VAT return, based on a VAT exclusive invoice received from a supplier.

If the supplier does not charge VAT in the first place and is not therefore paid VAT, he cannot pocket the VAT money and disappear without paying it to HMRC.

That is the intended outcome of the Domestic Reverse Charge regime: to reduce VAT fraud in the construction industry.

Domestic Reverse Charge – Builders Selling Services

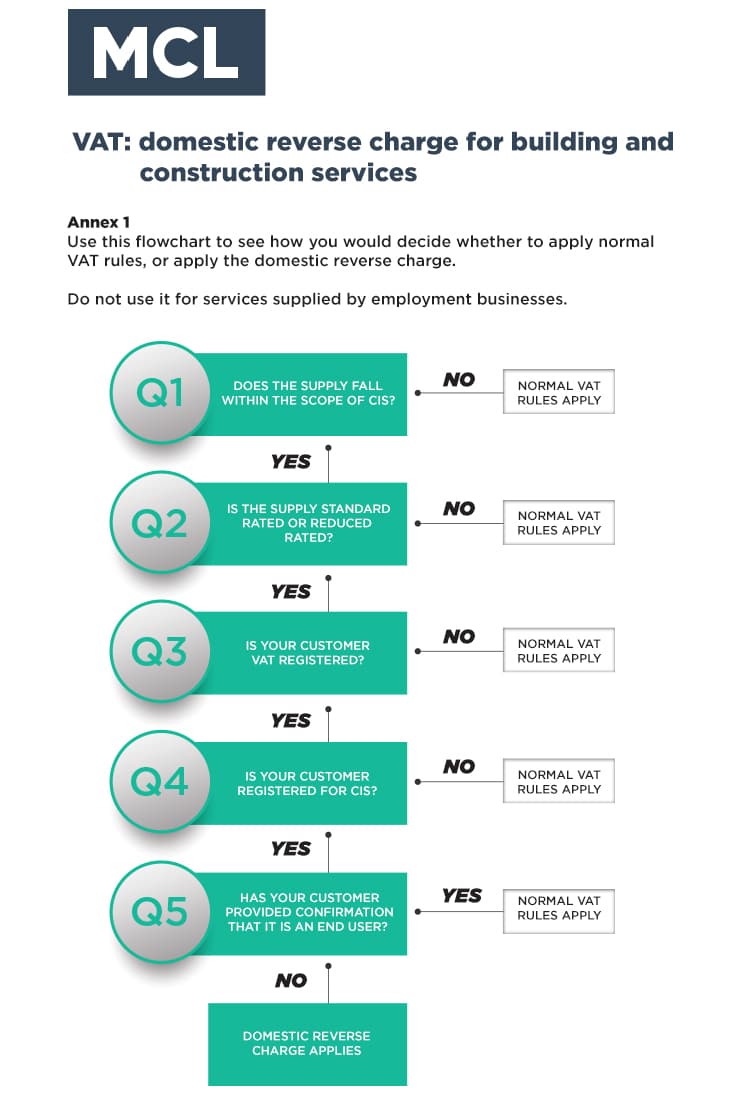

In the case of builders supplying services, there are five key questions to ask. If the answer to the first four questions is ‘yes’ and ‘no’ to the final question, the reverse charge will apply and no VAT will be charged on sales invoices raised for the job in question, and the customer should account for VAT instead.

-

Is the customer registered for the Construction Industry Scheme (CIS)?

If the answer to this question is ‘no’ the builder doesn’t need to worry about the reverse charge rules any further for this customer and can just adopt normal VAT accounting from 1 March 2021 – job done!

-

Is the customer registered for VAT?

This can be confirmed using HMRC’s new VAT number checker service. I recommend it is used by builders as a matter of course. I have tried it myself and give it 10 out of 10.

The worst-case scenario is for a builder not to charge VAT on a job that should have been subject to normal VAT rules, and HMRC raises an assessment for underpaid output tax.

-

Is the work within the scope of the CIS?

Traditional building services are obviously all included under the CIS, such as electricians, plumbers, bricklayers, decorators, carpenters etc. If in doubt, refer to the useful HMRC guidance on the CIS.

-

Is the work subject to either 5% or 20% VAT?

Any zero-rated sales are excluded from the new Domestic Reverse Charge regime, eg construction work on new dwellings.

-

Is the customer an end user or intermediary supplier for the work?

The Domestic Reverse Charge only applies if the customer makes an onward supply of construction services to their own customer i.e. the typical subcontractor, contractor and customer arrangement.

In cases where the contractor is not supplying on the construction services, the work is excluded from the reverse charge. This can happen where:

The customer is an ‘end user’

This would be relevant if, for example, a bricklayer carried out work at the head office of his builder customer, or perhaps at a property that the customer owns and rents out. In other words, the service is not supplied on by the builder receiving the bricklayer’s services.

The onus is on the customer to tell the bricklayer if it is an ‘end user’ for any job. If so, VAT will be charged in the normal way by the bricklayer.

The customer is an ‘intermediary supplier’

This is a business that is registered for both CIS and VAT that is connected or linked to end users. The connection is based on s1161, Companies Act 2006 (ie, the two entities are in the same corporate group or undertaking).

A link exists if both the intermediary supplier and the end user have a relevant interest in the same land where the work is taking place (eg, a landlord and tenant arrangement).

So, even though the intermediary supplier is making an onward supply of construction services to the end user, the supplies it receives from other builders, such as my imaginary bricklayer, will be subject to normal VAT rules rather than the reverse charge.

VAT Domestic Reverse Charge for the Construction Industry – Final Words

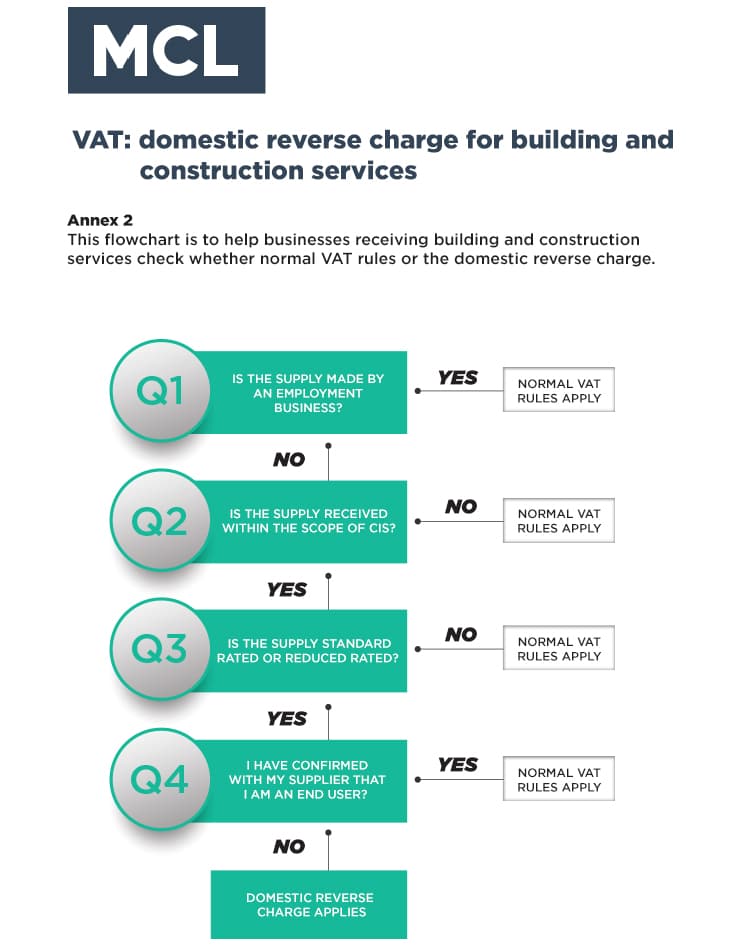

There are two helpful flowcharts in HMRC’s comprehensive guidance on the new rules and when they apply – one is for suppliers and one is for buyers (see section 25 of the technical guide). It is worth downloading them and sending them to your builder clients.

Contact MCL Accountants on 01702 593 029 to optimise your tax position or if you need any assistance with Domestic Reverse Charge regime or your company accounts.

Tags: Domestic Reverse Charge, VAT