Option to Tax Land and Buildings – How Can I Recover VAT on Purchase of Commercial Property?

15/10/2022 - 9 minutes readOption to tax land and buildings is a mandatory prerequisite if you would like to recover the VAT charged by the seller on the purchase of a commercial property or if you would like to undertake building work and recover any VAT charged by the builders on a building that you are developing for commercial purposes.

The scope of an option to tax

What you’re opting to tax

You are opting to tax land. For the purposes of VAT, the term ‘land’ includes buildings. When you opt to tax, you can specify an area of land or a ‘building’. Commonly, you will specify a ‘building’ because that is the prominent feature of the land. If you specify:

- – a building, the option to tax will continue to apply to the land on which the building stood if the building is demolished and to any future buildings constructed on the land

- – land, the option will apply to any buildings on the land and future buildings constructed on the land

HMRC’s VAT Notice 742A covers Option to Tax and we discuss this in further detail below.

In both circumstances, you can specifically exclude new buildings from the effect of an option to tax if you wish to (see paragraph 2.7). Further details about the scope of an option to tax are in paragraph 2.4.

What constitutes a ‘building’

Usually, it will be clear what constitutes a building, for instance, an office block or a factory. But in some instances, the law treats more than one building as being a single building for the purpose of the option to tax. These are:

- – buildings that are linked, or if not yet built are planned to be linked, see paragraph 2.3 for more information on links

- – a complex consisting of a number of units grouped around a fully enclosed concourse, such as a shopping mall

What a link is

A link is an internal access or a covered walkway between buildings the purpose of which is to allow the movement of goods and people.

It does not include a:

- – car park, either above or below ground

- – public thoroughfare

- – statutory requirement, such as a fire escape

What’s covered by the option to tax

HMRC uses a number of basic principles to determine how far your option to tax extends over the land and associated buildings.

| Option | Principle |

|---|---|

| Land | Your option to tax covers all the land, and any buildings or civil engineering works which are part of the land. Your option to tax will cover the discrete area of land that you specify, and will not affect any adjoining land. If you construct a new building on land that you have opted for, the building will be covered by the option to tax unless you notify us that you wish to exclude the building from the effect of the option (paragraph 2.7 explains how to do this). |

| Buildings | Your option to tax will cover the whole of the building, and the land under the building and within its curtilage (the land immediately around the building including, for example, forecourts and yards). If your interest in the building is restricted to one floor, your option to tax will still cover the remaining floors of the building. If the building stands in a large area of land, the extent of the curtilage (or how far the option to tax extends over the land) depends on how far the services of the building can be utilised. For example, a racecourse grandstand may provide electricity and shelter for stalls, or other facilities, within its peripheral area. An option to tax on the grandstand would extend over the whole area of land that uses the benefits. Equally, an option would normally extend to an area adjacent to a building which is put to a use that is ancillary to the use of the building, such as car parking. If the building is demolished or destroyed, your option to tax will still apply to the land on which the building stood and to any future buildings that are constructed on the land. But if you opted to tax before 1 June 2008 and it’s clear from your notification that the option was made on the building only, for example, you specified in your notification ‘Building at 1 High Street’, you can, if you wish, treat the option as revoked once the building is demolished. You do not need to notify us before revoking but you should retain evidence in case this is requested in the future. |

Opting to Tax, a 2-step process

There are 2 stages in opting to tax. The first stage is making the decision to opt. This may take place at a board meeting or similar, or less formally. However you reach your decision, you should keep a written record, showing clear details of the land or buildings you are opting to tax, and the date you made your decision.

If you have previously made exempt supplies of the land or building you may need HMRC’s permission before you can opt to tax. You can find more information about this here.

The second stage is to notify HMRC of your decision in writing as per below.

Notification of an option to tax

When to notify

For your option to tax to be valid you, as an authorised signatory (see paragraph 7.6), must normally make your notification within 30 days of your decision. You can ask HMRC to accept a notification made more than 30 days after your decision but we will not do so unless we are satisfied that you made your decision to opt at the relevant time. If you would like us to consider accepting a belated notification, you should enclose with your notification an explanation of your circumstances and any evidence that will help to show us that the decision was made at the relevant time.

We will normally accept a belated notification if you provide either:

- – direct documentary evidence that the decision was made at the relevant time (for example, copies of correspondence with third parties referring to the option to tax)

- – evidence that output tax has been charged and accounted for and input tax claimed in accordance with the option and a responsible person (such as a director) provides a written declaration that the decision to opt was made at the relevant time and that all relevant facts have been given

HMRC might accept a late notification in other circumstances. This will depend on the facts of your case.

What to include in your notification

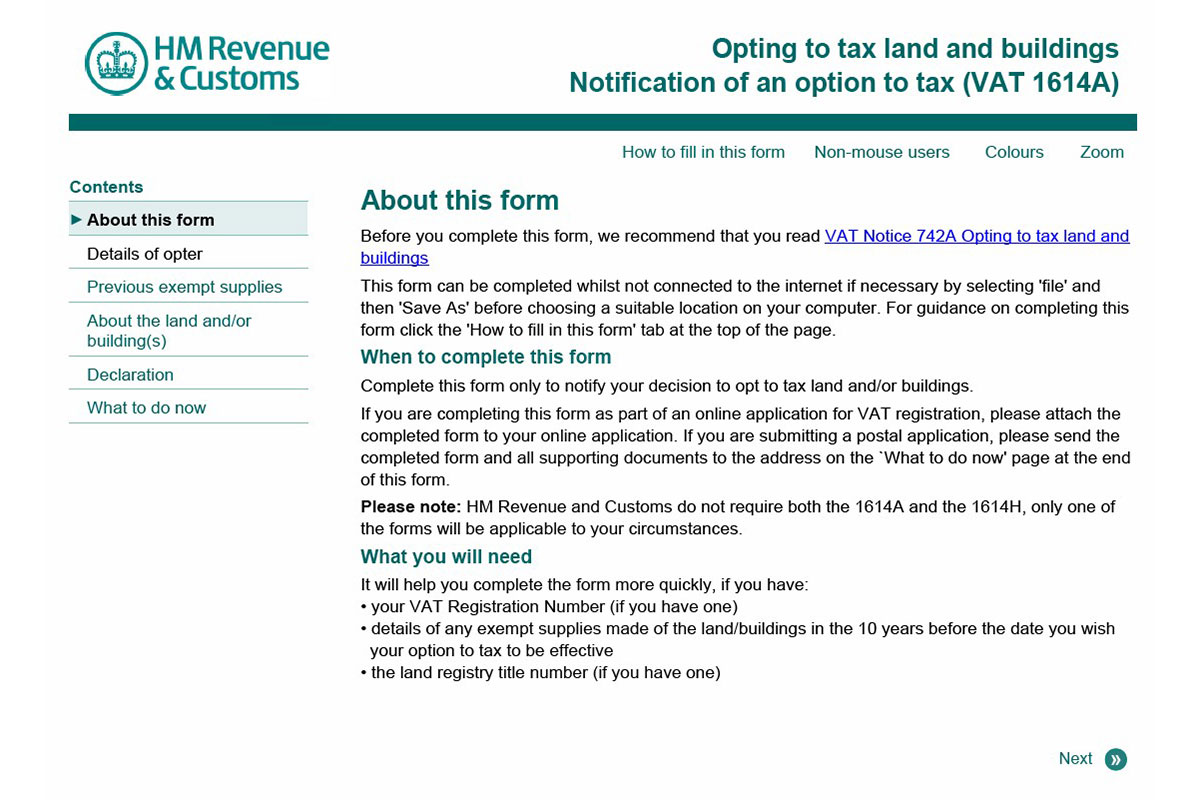

Your notification must state clearly what land or buildings you are opting to tax, and the date from which the option has an effect (see paragraph 4.3). You can use the notification form VAT1614A VAT: notification of an option to tax land and buildings.

If you’re opting to tax discrete areas of land you should send HMRC a map or plan clearly showing the opted land with your notification. If you’re opting for a building that has a postal address give it in full including the postcode.

It would speed up our processing of your notification if you include your VAT registration number, or if your registration is pending your VAT Registration Unit reference number.

It’s important that an appropriate person signs the notification and any accompanying list or schedule. See section 7 and paragraph 7.6 for more information.

Where to send notification

If you’ve already registered for VAT you can post your notification, or email a scanned letter or form to the Option to Tax Unit.

If you’re not registered but need or wish to be registered for VAT as a result of your option to tax, submit your application to register for VAT and your notification of the option to tax to the appropriate VAT Registration Unit.

Read VAT Notice 700/1 to find out when you must register for VAT and how to do it.

Acknowledgement of notifications

The option to tax has a legal effect even if HMRC does not acknowledge receipt of your notification. You should begin charging VAT, even if you have not received an acknowledgement from HMRC.

The effective date of your option to tax

Your option to tax will have effect from the date of your decision, or any later date that you have specified, as long as you notify HMRC in writing within the relevant time limits (see paragraph 4.2).

In no circumstances can an option to tax have effect from a date before you made your decision to opt.

How can MCL Accountants help?

Contact MCL Accountants on 01702 593 029 if you have any queries on the Option to tax land and buildings or if you need any assistance with the preparation and submission of your business accounts or self-assessment tax returns to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments