Letter from HMRC about Overseas Assets, Income or Gains

22/01/2022 - 10 minutes readHave you received a letter from HMRC about overseas assets, income or gains? If yes, read on to find out what you should do next.

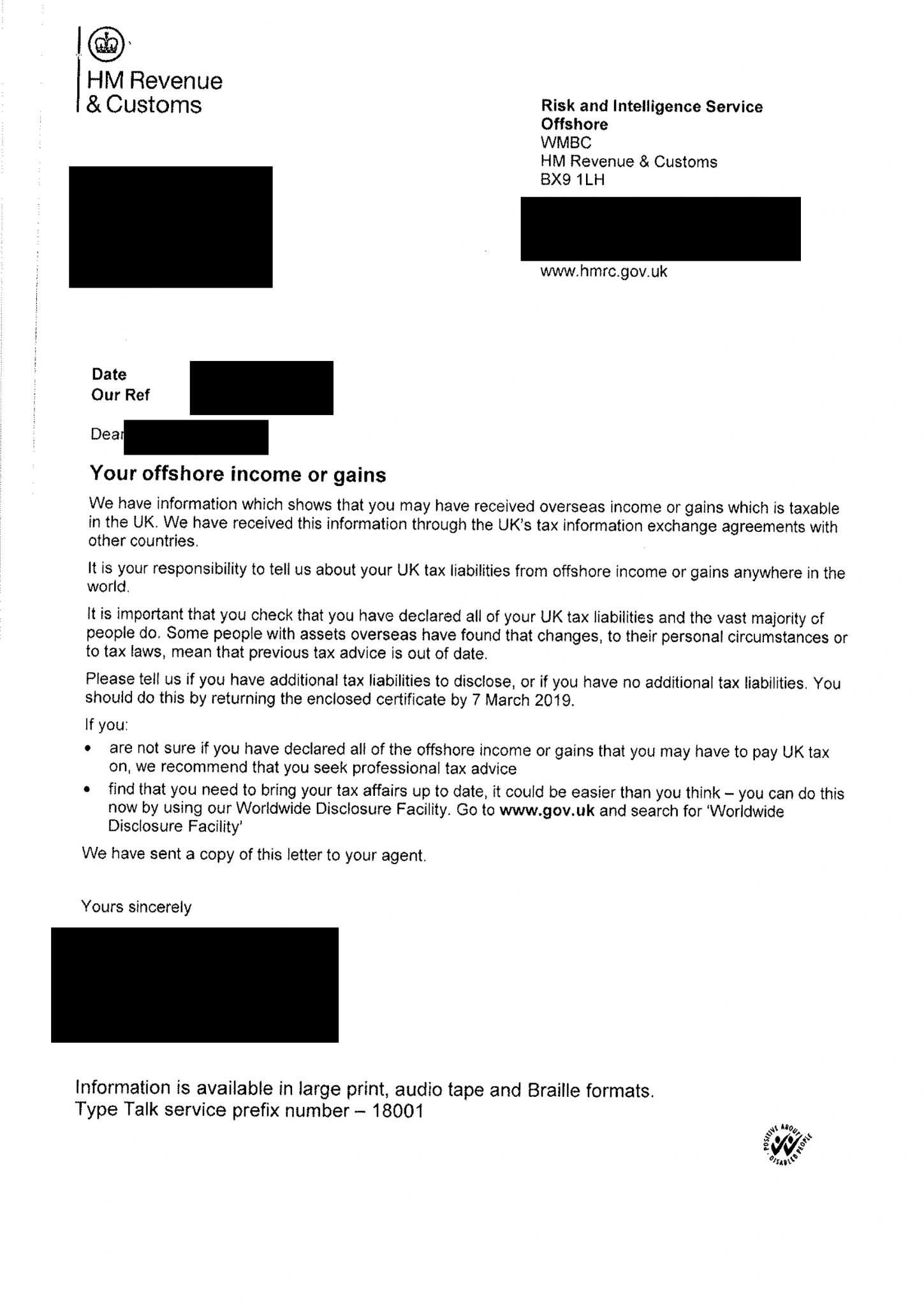

“Notification letter” from HMRC

Does the letter from HMRC state that they have information that shows you may have received overseas income or gains that you may have to pay UK tax on and they have received this information through the UK’s tax information exchange agreements with other countries?

If so then do not worry, this is not a notice to prosecute you for tax evasion and this letter from HMRC is part of their “nudge letter” campaign prompting taxpayers to bring their tax affairs up to date. This letter from HMRC about your overseas income is also referred to as “notification letter“.

HMRC aren’t targeting you specifically because they have carried out a tax investigation against you, this letter has merely been generated by HMRC’s system as your details have been included on a list provided to HMRC by regulated financial institutions (such as banks) in other countries about individuals who have received interest income, rental income, dividends etc. in a foreign country.

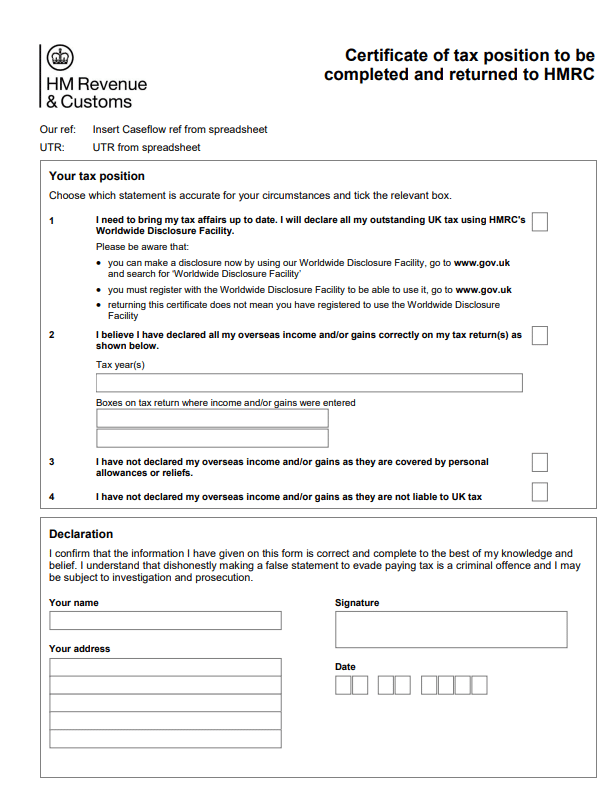

This letter from HMRC is often accompanied by a “Certificate of tax position” that HMRC ask you to complete and return to them by selecting one of the 4 options listed on the certificate.

If you get the notification letter from HMRC about your money or assets abroad, you’ll need to check your tax affairs are up to date, then either:

- – Tick Box 2, 3 or 4 depending upon which box is relevant to your situation – if you’ve already declared and paid any UK tax you owe or if there is no tax payable if it’s covered by personal allowance or reliefs.

- – Tick Box 1 and make a disclosure to HM Revenue and Customs (HMRC) – if you’ve got undeclared money or assets abroad.

Check your tax affairs are up to date

When you get the notification letter from HMRC, you’ll need to check your tax affairs are up to date by making sure you’ve declared and paid UK tax on your money or assets abroad.

You don’t need to do anything else if you’ve already told HMRC about your foreign income or assets and paid the UK tax due.

If you find you’ve got undeclared foreign income or assets, you’ll need to make a disclosure to HMRC.

Disclose any undeclared foreign income

If you check your offshore tax affairs and find undeclared money or assets abroad, you’ll need to tell HMRC by making a disclosure. You can do this through HMRC’s Worldwide Disclosure Facility. We cover this in detail in a separate article here.

To make a disclosure you’ll need to:

- – make sure you can use the facility – if you can’t then contact HMRC

- – use the Worldwide Disclosure Facility guide to help you register and make your disclosure

- – use HMRC’s digital disclosure service to register for the facility if you’re making the disclosure yourself

- – get your agent to register for the facility on your behalf if they’re making the disclosure for you

When you register for the facility, you ‘notify HMRC of your intent to disclose’. You’ll have 90 days to make your disclosure from the date you register.

You could be charged further penalties if you don’t declare foreign income or assets, so it’s better to tell HMRC as soon as possible. Making a disclosure could help reduce the amount of penalty you have to pay.

How to pay what you owe

You’ll need to pay the full amount you owe at the same time as you make the disclosure. You’ll get full details of how to pay during the disclosure process.

Letter from HMRC – How can MCL Accountants help?

We have recently assisted a large number of clients who have received a letter from HMRC regarding their offshore income or gains which are taxable in the UK but the clients weren’t aware that they had to declare such income on their tax returns.

Examples include clients with foreign bank accounts where they received bank interest as well as dividends received from foreign companies. A lot of clients have NRE and NRO bank accounts in India which are used to hold Indian Rupees in the NRE account and fixed deposits in INR.

If a client has paid tax on interest in India and they can provide a TDS certificate or an Indian tax return confirming the amount of tax paid, then such tax can be used to offset tax due to HMRC by utilising the “foreign tax credit” relief. If you have a PAN in India then you can request a form 26AS to confirm the amount of tax paid in India on bank interest income if you are unable to obtain TDS certificates from your bank.

We have also heard from a lot of clients who have moved from Hong Kong to UK and they have forgotten to declare their bank interest, dividend & rental income from Hong Kong on their UK tax return and as a result, they have received a notification letter from HMRC.

Other clients include EU nationals who have moved to the UK in the last decade and still receive bank interest income and rental property income from EU countries & they have forgotten to include this income on their tax return and upon receipt of this notification letter from HMRC, they need to declare this income using the Worldwide Disclosure Facility.

For ex: German, Spanish, Italian or Portugese nationals living in the UK since 2011 but if they are in receipt of bank interest income or they have rented out their former residence in their home country, they will usually pay tax in their home country but they may not be aware that such income needs to be declared to HMRC too and any tax paid abroad can be used to offset tax due to HMRC by utilising the “foreign tax credit” relief when using the Worldwide Disclosure Facility.

If you have received a letter from HMRC about your overseas income then please get in touch with us to discuss the next steps.

Whether the worldwide disclosure relates to bank interest earned in India from private banks such as HDFC Bank, ICICI Bank, Bank of Baroda, Bank of India, Syndicate Bank etc. or if the undisclosed income relates to dividends on Swiss shares from a multinational employer such as UBS or any earnings from bank interest income and rental income from the EU, we are here to help!

We will always give you an honest appraisal of your position, including potential fees, whether it is favourable or not.

Our team is accessible and approachable, and ready to answer your questions, giving you the confidence you need when dealing with a sensitive issue such as an HMRC enquiry or other tax dispute.

Contact MCL Accountants on 01702 593 029 if you need any assistance with completing the certificate of tax position, setting up your Worldwide Disclosure facility and making a full disclosure to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments