Tax Changes from April 2023 for Limited Companies & Individual Taxpayers

08/04/2023 - 6 minutes readTax changes from April 2023 have now taken effect with the start of the new personal tax year from 06th April.

Tax changes from April 2023 impact limited companies as well as individual taxpayers – read on to find out whether you will end up paying more tax this year due to these changes.

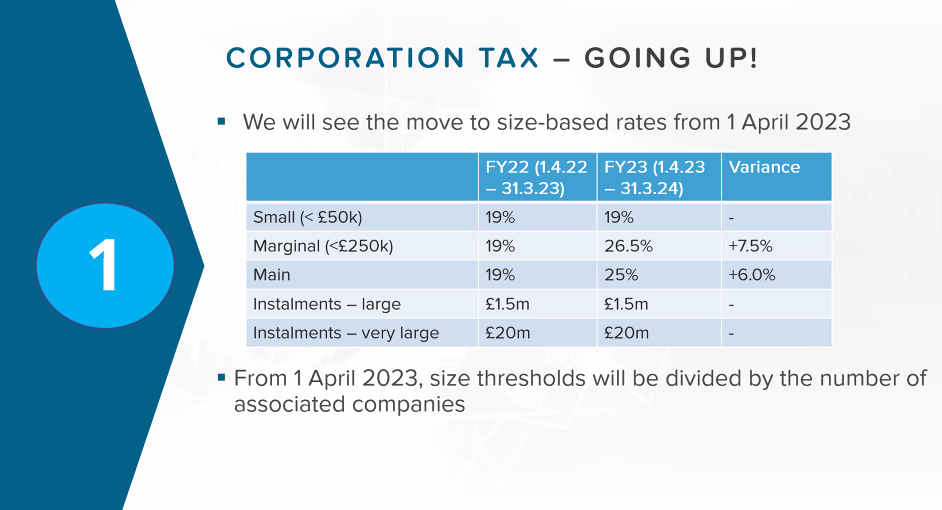

Corporation Tax

As part of the tax changes from April 2023, the corporation tax rate has increased by a third from 19% to 25% for the largest businesses from 1 April and full expensing is available for three years.

Businesses with profits below £50,000 will not be affected as the government has introduced a small profit rate for those companies.

As a result of the corporation tax rate increase, the full rate of 25% will be applicable to businesses making profits of over £250,000. Businesses earning profits between £50,000 to £250,000 will be able to claim marginal relief which was long forgotten about a decade ago. See further details here.

Corporation tax increase for Group Companies

Tax changes from April 2023 also impact group companies as the lower and upper limits will be proportionately reduced for short accounting periods and where there are associated companies. A company is associated with another company at a particular time if, at that time or at any other time within the preceding 12 months:

- – one company has control of the other

- – both companies are under the control of the same person or group of persons.

We discuss the Tax changes from April 2023 for associated companies for corporation tax in a separate article here.

Capital allowances

There are also changes to capital allowances as part of the tax changes from April 2023 after the withdrawal of the 130% super deduction from 31 March.

Companies incurring qualifying expenditure on the provision of new plant and machinery on or after 1 April 2023 until 31 March 2026 will be able to claim one of two temporary first-year allowances. These allowances are:

- – a 100% first-year allowance for main rate expenditure – full expensing; and

- – a 50% first-year allowance for special rate expenditure.

The annual investment allowance has been set at £1m on a permanent basis from 1 April. This will be a welcome change after years of yo-yo-ing limits. This capital allowance is available to nearly all incorporated and unincorporated businesses, covering expenditure on most plant and machinery including second-hand assets and those acquired for leasing.

The first-year allowance for electric vehicle charge points has been extended until 31 March 2025 for corporation tax purposes and 5 April 2025 for income tax purposes.

Frozen tax thresholds & additional rate thresholds lowered

As part of the tax changes from April 2023, the additional rate threshold will be lowered from £150,000 to £125,140 from 6 April and this is the income level at which an individual will not have any personal allowance because £1 of the personal allowance is withdrawn for every £2 of income above £100,000.

The change in the threshold will see an additional 232,000 taxpayers drawn into additional rate tax for the first time, according to HMRC. For those with income between £125,140 and £150,000, the average cash loss is £621.

Base rate and higher rate thresholds are frozen until 2028 at £12,570 and £50,271 respectively. This will pull more taxpayers into higher rate tax, with over a million expected to face 40% tax charges for the first time as a result of the freeze.

Dividend tax

Dividend tax changes from April 2023 will result in the dividend allowance being halved to £1,000 from 6th April 2023 onwards. This annual dividend allowance will be reduced further down to £500 per annum from April 2024 onwards. We cover dividend tax rates from April 2023 in a separate article here.

Capital gains tax

Tax changes from April 2023 will also impact Capital gains tax where the CGT allowance has been reduced down from £12,300 in 2022/23 to £6,000 in 2023/24.

The annual exempt amount will be £6,000 for individuals and personal representatives, and £3,000 for most trustees. Note that is exempt allowance will be reduced further in 2024-25 to £3,000 for individuals, and only £1,500 for most trustees.

The rates of capital gains tax remain unchanged at a 10% basic rate and a 20% higher rate, but on residential property, apart from primary residences, the rates are 18% and 28% depending on the earnings bracket.

The government has also abolished the annual uprating of the annual exempt amount in line with CPI and has fixed the CGT reporting proceeds limit at £50,000.

How can MCL Accountants help?

Contact MCL Accountants on 01702 593 029 if you would like further information about Tax changes from April 2023 or if you need any assistance with the preparation and submission of your business accounts or self-assessment tax returns to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments