Corporation Tax Rate Increase in 2023 from 19% to 25% – Confirmed after Mini-Budget “U-Turn”

19/03/2022 - 5 minutes readThe planned increase in April 2023 to the corporation tax rate (from 19% to 25%) for companies making more than £250,000 profit has been “reinstated” after Prime Minister Liz Truss made another “U-turn” on 14th Oct 2022.

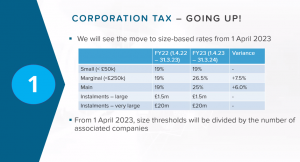

Corporation tax rate will increase to 25% from April 2023 which will result in the return of the small profit rate and main rate of corporation tax.

Once the corporation tax rate increase takes effect in April 2023, the applicable corporation tax rates will be 19% and 25%. Businesses with profits of £50,000 or below would still only have to pay 19% under small profit rate.

Corporation Tax Rate Increase in 2023 from 19% to 25%

As a result of the corporation tax rate increase, the full rate of 25% will be applicable to businesses making profits of over £250,000. Businesses earning profits between £50,000 to £250,000 will be able to claim marginal relief which was long forgotten about a decade ago.

As per the proposal for corporation tax rate increase, new corporation tax rates will be:

| Financial year 2020 to 2021 | Financial year 2021 to 2022 | Financial year 2022 to 2023 | Financial year 2023 to 2024 | |

|---|---|---|---|---|

| Main rate | 19% | 19% | 19% | 25% |

| Small profits rate | n/a | n/a | n/a | 19% |

| Lower threshold | n/a | n/a | n/a | £50,000 |

| Upper threshold | n/a | n/a | n/a | £250,000 |

What is Marginal Relief

Marginal Relief provides a gradual increase in corporation tax rate between the small profits rate and the main rate.

This applies where the profits of a company for an accounting period exceed a ‘lower limit’ but do not exceed an ‘upper limit’.

Who can claim Marginal Relief due to corporation tax rate increase

Your company or organisation may be able to claim Marginal Relief and pay less corporation tax if its taxable profits before 1 April 2015 are between:

- – £300,000 (the lower limit)

- – £1.5 million (the upper limit)

If your company has one or more associated companies, these limits are divided by the total number of associated companies.

A company is an associated company of another at a given time, if at that time:

- – one of the companies has control of the other

- – both companies are controlled by the same companies or people

For example, if one company owns 3 others, divide the thresholds by 4. The lower limit becomes £75,000 and the upper limit becomes £375,000.

If your accounting period is shorter than 12 months these limits are proportionately reduced. This means that for a 6 month accounting period the lower limit is halved to £37,500 and the upper limit to £187,500.

Definition of Control

Control for this purpose is the definition used for close companies.

A person has control of a company if they exercise, are able to exercise, or are entitled to acquire, direct or indirect control over the company’s affairs.

This includes possession or entitlement to the greater part of the voting power, share capital, distributed income or assets on a winding up of the company.

Find out further information about associated companies and close companies.

Corporation tax increase for Group Companies

The lower and upper limits will be proportionately reduced for short accounting periods and where there are associated companies. A company is associated with another company at a particular time if, at that time or at any other time within the preceding 12 months:

- – one company has control of the other

- – both companies are under the control of the same person or group of persons.

The related 51% group company test at s279F to s269H CTA 2010 will be repealed and replaced by associated company rules.

The thresholds that apply for determining whether a company is chargeable at the small ring fence profits rate at s279E Corporation Tax Act 2010 will be aligned with these limits.

What will be the corporation tax rate for profits between £50k and £250k?

As a result of this corporation tax rate increase, any profits between £50k and £250k will effectively be taxed at 26.5% due to the marginal relief rates as issued by Hmrc.

How to claim Marginal Relief

You can either:

- – provide details in your online Company Tax Return (your filing software should work it out for you)

- – amend your Company Tax Return within 12 months of the filing date

How can MCL Accountants help?

Contact MCL Accountants on 01702 593 029 if you have any queries on the Corporation tax rate increase or if you need any assistance with the preparation and submission of your business accounts or self-assessment tax returns to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments