Associated Companies for Corporation Tax – New Rules from April 2023

25/02/2023 - 7 minutes readAssociated Companies for Corporation tax is a frequently asked question by clients who own or control more than 1 company. Where two or more companies are “associated” with each other, the Corporation tax limits are divided by the number of companies concerned.

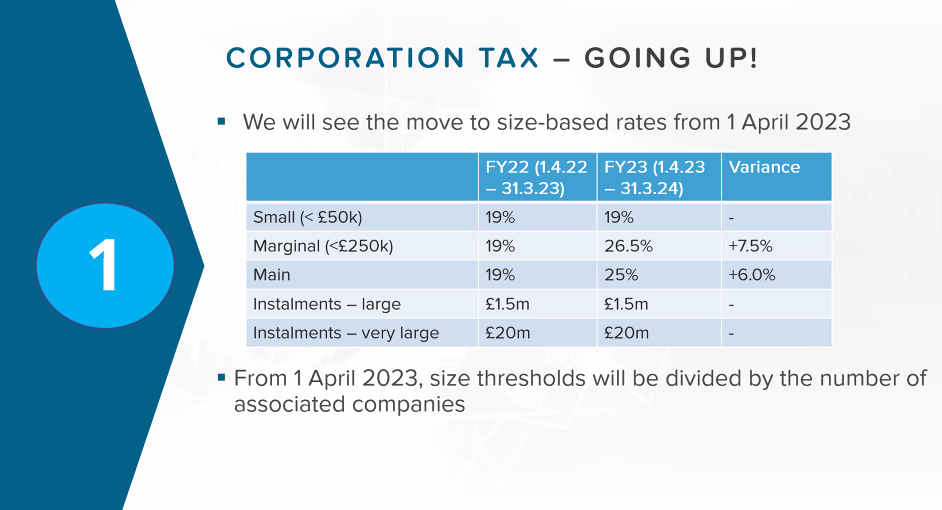

Associated Companies for Corporation Tax rules have been newly reintroduced and they will apply from 1 April 2023 in the context of the small companies’ rate of corporation tax.

The corporation tax rate will increase to 25% from April 2023 which will result in the return of the small profit rate and main rate of corporation tax.

As a result of the corporation tax rate increase, the full rate of 25% will be applicable to businesses making profits of over £250,000. Businesses earning profits between £50,000 to £250,000 will be able to claim marginal relief which was long forgotten about a decade ago. We discuss this in further detail here and you can use HMRC’s calculator to calculate marginal relief.

A company is an ‘associated company for corporation tax’ of another company if one of the two has control of the other, or both are under the control of the same person or persons (CTA10/S25 (4). ‘Control’ for this purpose is defined as for close companies (CTA10/PART10, S450 and S451, see CTM60210).

Companies may be classed as ‘associated companies for corporation tax’ no matter where it is resident for tax purposes.

Main rules of association

- – an associated company is counted even if it is an associated company for part only of an accounting period (but see CTM03640)

- – two or more associated companies are counted even if they are associated companies for different parts of the accounting period

- – an associated company which has not carried on any trade or business (see CTM03590) at any time during the accounting period is disregarded – if it is an associated company for part only of the accounting period, the rule applies to any time during that part.

Let’s use an example below to explain how associated companies for corporation tax rules work:

Example of Associated Companies for Corporation Tax New Rules

Company A: The shares are owned 75% by the husband, and 25% by the wife. The company’s only activity is the trade of providing engineering technical and consultancy services. The business is conducted solely by the husband as its only director-employee.

Company B: The shares in this company are owned 80% by the wife, and 20% by the husband.

The company’s only trade is the provision of educational training, and this is carried out solely by the wife as the only director-employee.

Despite the mutual shareholdings in each other’s company, and given the separate and distinct businesses concerned, the husband and wife control and run their respective companies independently of each other. In the early years of Company B, there were occasional short-term loans of money from Company A, or the lending of assets (for example, company vehicles).

Do we need to reduce the CT limits after applying the new associated companies for corporation tax rules?

In considering control by shareholders, we are required to attribute the rights of “associates”, a definition which includes spouses and civil partners (s18G CTA 2010).

At first glance, we might therefore conclude that the two companies in question are clearly associated companies for corporation tax because of the spousal relationship of the respective controlling shareholders. However, provisions with the legislation permit a disregard of companies under the control of associates, provided that there is no “substantial commercial interdependence” (SCI) between the companies concerned (s18G CTA 2010).

SCI is defined for these purposes by reference to the existing definitions given in the Employers Allowance legislation (para 3, Schedule 1 National Insurance Contributions Act 2014) and focuses on the extent of the following factors between the companies:

Financial interdependence – direct or indirect financial support between the companies.

Economic interdependence – companies would be ‘economically interdependent’ if (in particular) they seek to realise the same economic objective, the activities of one benefit the other, or they have common customers.

Organisational interdependence – this will be the case where the businesses of the companies have common management/employees, common premises, or common equipment.

The historical inter-company transactions referred to above would have little significance in the current period where no similar transactions have taken place recently. In the above example, it seems clear that there would be no current SCI between the two companies, and each can calculate and pay its own corporation tax liability without regard to the other.

HMRC’s updated guidance on the small profits rate is at CTM03900 and note HMRC’s comments at CTM03950 where they confirm each case will depend on its own specific circumstances – note especially the comments in the final two paragraphs. Therefore, it is not simply a question of whether the two companies run separate businesses but also whether and how they operate in conjunction with each other.

In the above example, companies seemingly have no financial, economic or organisational interdependence then at present there is no substantial inter-dependence. Remember that under s18E CTA 2010, the test is whether they are associated companies for corporation tax at any time in the accounting period and so this must be constantly reviewed.

The foregoing is, of course, subject to any changes that may be made in the forthcoming Budget.

How can MCL Accountants help you ascertain whether you have any Associated Companies for Corporation Tax?

Contact MCL Accountants on 01702 593 029 if you would like to review your current business setup & ascertain whether you have any Associated Companies for Corporation tax or if you need any assistance with the preparation and submission of your business accounts or self-assessment tax returns to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments