Dividend Tax Increase from April 2022 Across All Tax Bands

The 1.25% Dividend tax increase applies to all business owners and investors and is being brought in to help support the NHS and social care.

The 1.25% Dividend tax increase applies to all business owners and investors and is being brought in to help support the NHS and social care.

If you’re a business that wants to move goods into or out of a Freeport, you will need to apply to use the Freeport customs special procedure. Click through to learn more.

New trade rules for full customs declarations and controls are going to be introduced from 1 January 2022. Click through to learn more!

One of the most frequently asked questions by our clients these days is how to

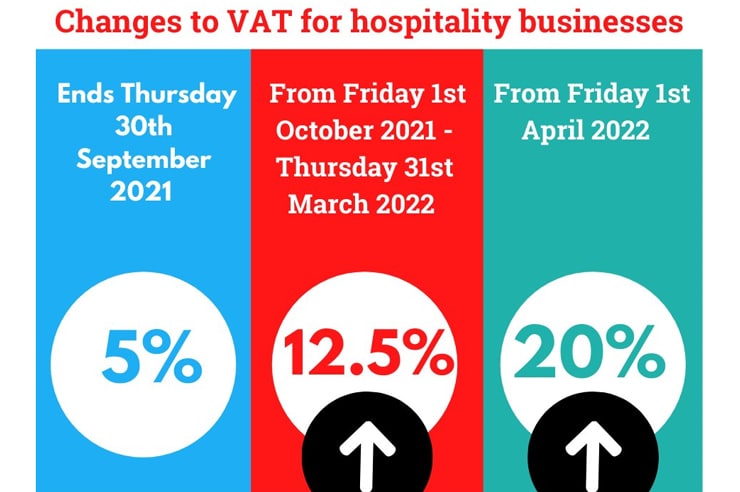

VAT rate increase from 1 October 2021 applies to hospitality businesses and the VAT rate

Can you recover the VAT on the company car? This is a question that has been asked multiple times by employers providing their employees with a car.

1.25% tax increase to cover social care costs has been announced for all taxpayers under

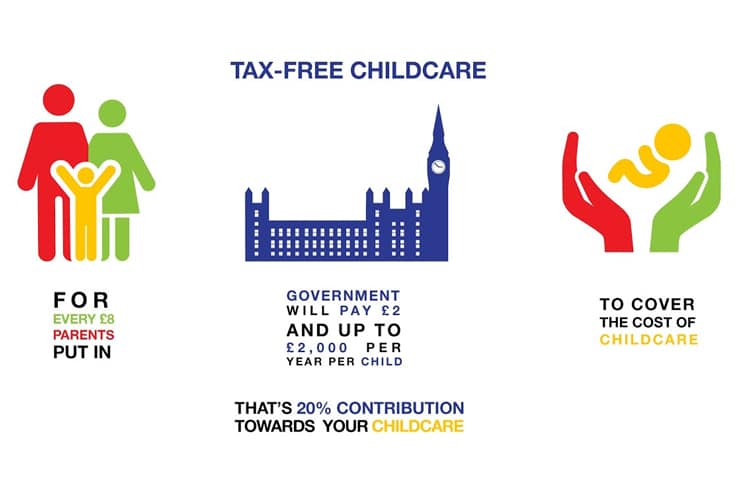

HMRC has issued a reminder to families that are eligible for tax-free childcare that they can use the scheme to help with their childcare costs.

MTD for Income Tax is a service that enables businesses and landlords to keep their records digitally and submit information about their business income to HMRC using MTD-compatible software.

The government has given less than a year’s notice of a new tax it proposes to levy on profits made from residential property development from 1 April 2022.

MTD for income tax will be effective from 6 April 2024 for all sole traders, landlords etc. irrespective of when their current accounting period ends with MTD for general partnerships postponed to 2025.

This week we’re answering questions about the Import One Stop Shop (IOSS), an e-commerce system recently introduced by the EU to simplify the payment of VAT.