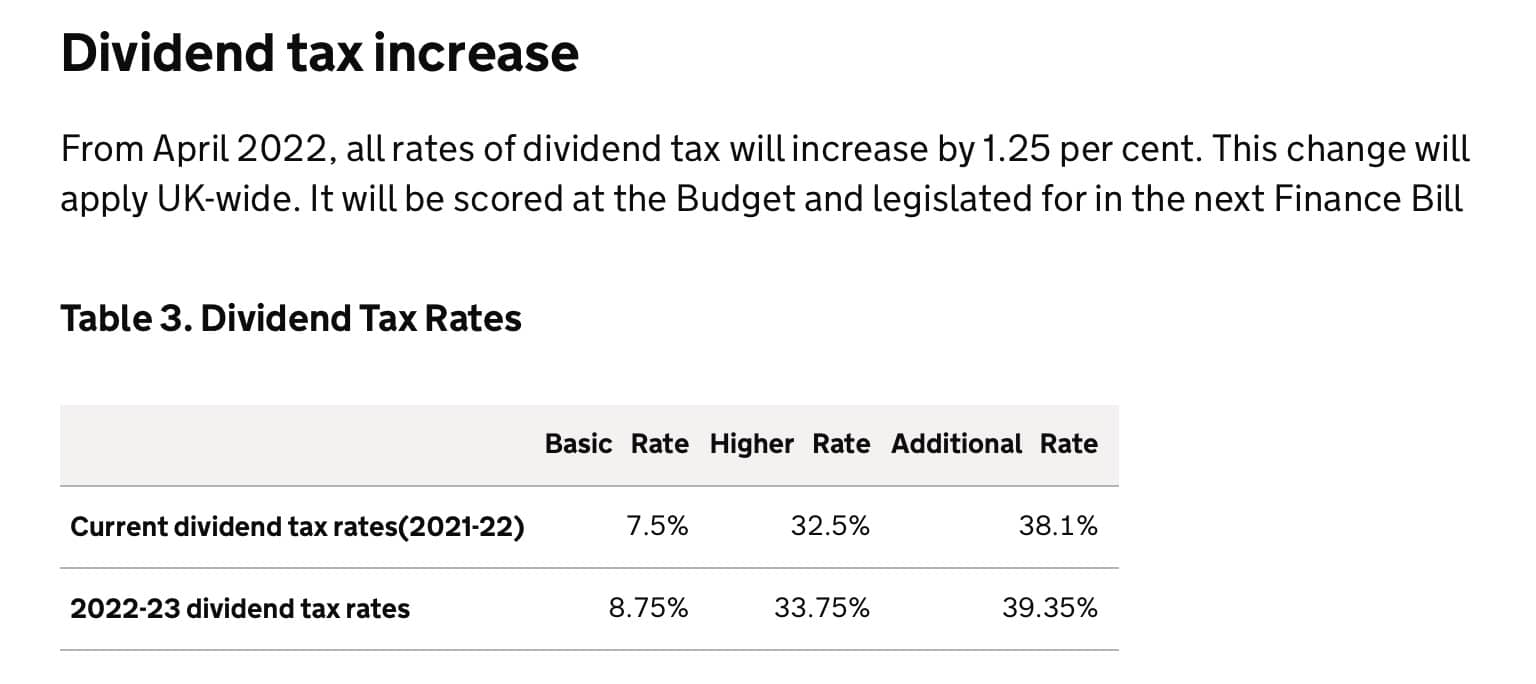

Dividend Tax Increase from April 2022 Across All Tax Bands

23/10/2021 - 5 minutes readDividend tax increase from April 2022 applies to all business owners and investors and the proposed increase of 1.25% is being brought in to help support the NHS and social care.

Who can receive a dividend?

A dividend is a payment of profits (after corporation tax) to shareholders of a company. Business owners can pay themselves through a salary or dividend, or a combination of the two. Profits extracted from the company can be spent freely, whereas funds reinvested must be applied wholly and exclusively for the benefit of the company.

Dividend Tax Increase from April 2022 Across All Tax Bands

How are dividends taxed?

You can earn some dividend income each year without paying tax.

You do not pay tax on any dividend income that falls within your Personal Allowance (the amount of income you can earn each year without paying tax).

You also get a dividend allowance each year. You only pay tax on any dividend income above the dividend allowance.

You do not pay tax on dividends from shares in an ISA.

The government says that due to the combination of the tax-free dividend allowance and the personal allowance, around 60% of individuals with dividend income outside of ISAs aren’t expected to pay dividend tax and aren’t expected to be affected by the dividend tax increase from April 2022.

Dividend allowance

| Tax year | Dividend allowance |

|---|---|

| 6 April 2021 to 5 April 2022 | £2,000 |

| 6 April 2020 to 5 April 2021 | £2,000 |

| 6 April 2019 to 5 April 2020 | £2,000 |

| 6 April 2018 to 5 April 2019 | £2,000 |

| 6 April 2017 to 5 April 2018 | £5,000 |

| 6 April 2016 to 5 April 2017 | £5,000 |

The rules are different for dividends before 6 April 2016.

What are the benefits of paying yourself dividends from your company?

From a tax perspective, it has historically been beneficial to extract income in the form of dividends, as dividends have attracted lower rates of income tax than being paid a salary.

Additionally, each person has a tax-free dividend allowance (currently £2,000) which means that tax is only payable on dividends above this rate. This allowance is on top of the income tax personal allowance, so it can be advantageous to utilise these allowances by taking income as a combination of both salary and dividends.

Working out tax on dividends after the Dividend tax increase

How much tax you pay on dividends above the dividend allowance depends on your Income Tax band.

To work out your tax band, add your total dividend income to your other income. You may pay tax at more than one rate.

The government estimates that as a result of the dividend tax increase from April 2022, taxpayers will pay an average of £150 more on their dividend income in 2022-23. Affected higher-rate taxpayers are expected to pay, on average, an additional £403.

Basic-rate payers receiving £3,000 in dividends must pay dividend tax of £1,000 and see their bill rise from £75 to £87.50 due to the dividend tax increase from April 2022.

Any Higher rate tax payers taking £10,000 in dividend payments needs to pay 33.75 per cent on £8,000 of dividends with a dividend tax bill of £2,700.

Due to the dividend tax increase from April 2022, this is an increase of £100 from the current system.

S455 tax rates to increase by 1.25% too

Since the rate of tax that applies to overdrawn Directors loan accounts under s455 CTA 2010 is directly linked to the dividend upper rate this will mean that the s455 rate will also increase from April 2022, from 32.5% to 33.75% due to the dividend tax increase.

Pay tax on up to £10,000 in dividends

Tell HMRC by:

- – contacting the helpline

- – asking HMRC to change your tax code – the tax will be taken from your wages or pension

- – putting it in your Self Assessment tax return, if you already fill one in

You do not need to tell HMRC if your dividends are within the dividend allowance for the tax year.

Pay tax on over £10,000 in dividends

You’ll need to fill in a Self Assessment tax return.

If you do not usually send a tax return, you need to register by 5 October following the tax year you had the income.

How can MCL Accountants help?

Contact MCL Accountants on 01702 593 029 if you have any queries on the Dividend tax increase from April 2022 or if you need any assistance with the preparation and submission of your business accounts or self-assessment tax returns to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments