Tax-Free Childcare Scheme: Who Qualifies & How Does It Work

04/09/2021 - 8 minutes readWhat is Tax-free Childcare Scheme

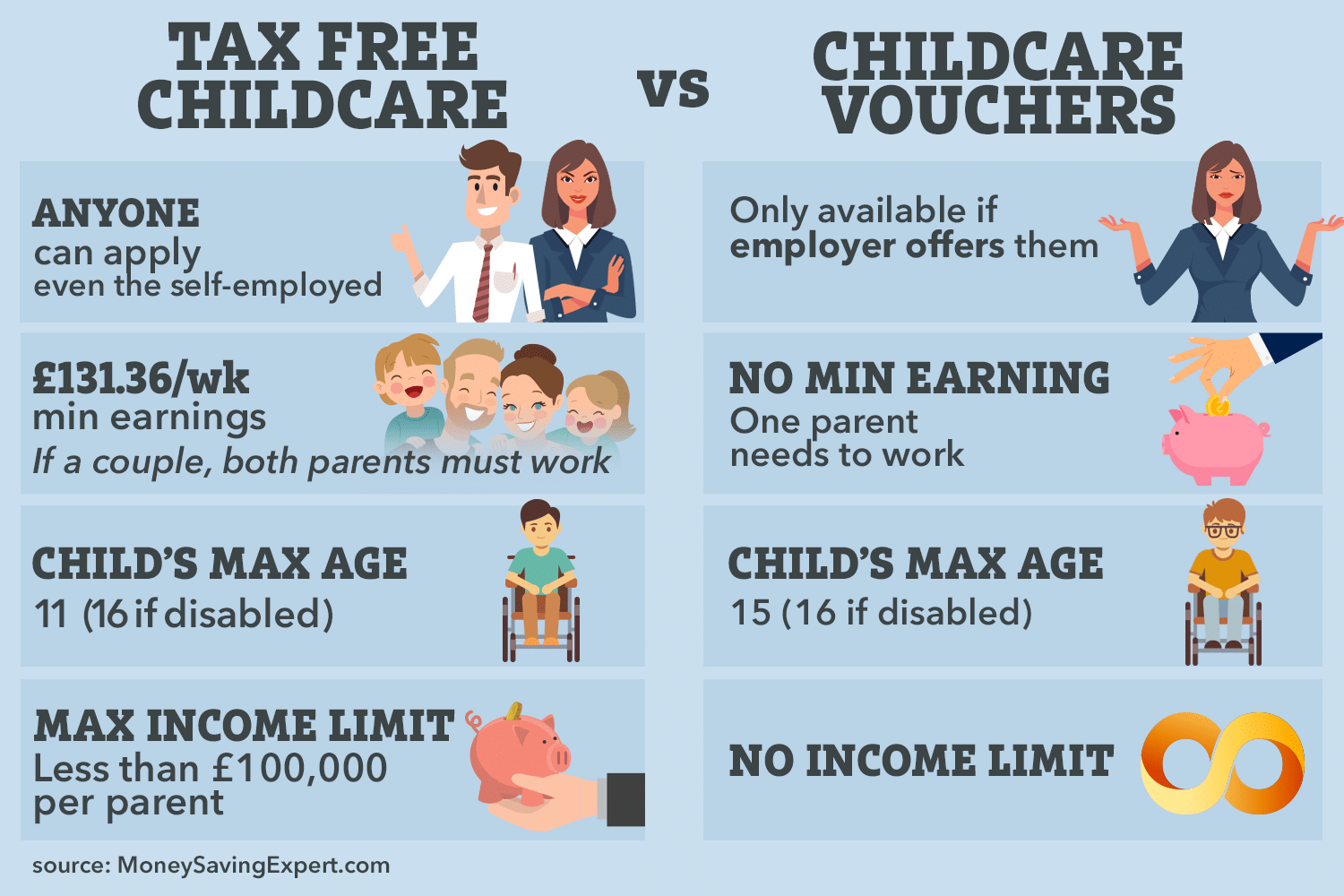

The tax-free childcare scheme is available to parents or carers who have children aged up to 11, or 17 if their child is disabled and for every £8 a parent or carer deposits into their account, they will receive a £2 top-up to the value of £500 every three months, or £1,000 if their child is disabled.

HMRC has issued a reminder to families that are eligible for tax-free childcare that they can use the scheme to help with their childcare costs as children go back to school.

The tax authority states that eligible families can save money on their childcare benefit from a government top-up worth up to £2,000 every year or £4,000 a year if a child is disabled.

HMRC state that the 20% top-up is paid into the tax-free childcare account and is ready to use almost instantly, meaning parents and carers can use the money towards the cost of childminders, breakfast, and after school clubs, and approved play schemes.

In June 2021, about 308,000 families across the UK benefited from using tax-free childcare, but HMRC says that thousands of those eligible are missing out on this opportunity.

HMRC reminds parents that tax-free childcare is also available for pre-school-aged children attending nurseries, childminders, or other accredited childcare providers.

Parents and carers, who are returning to work after parental leave, can apply for a tax-free childcare account for that child before they need to start using it and families are able to start depositing money 31 days before they return to work.

By doing this HMRC says it can maximise the potential government top-up saving.

Childcare providers are also able to sign up for a childcare provider account through GOV.UK to receive payments from parents and carers via the scheme.

You can get up to £500 every 3 months (up to £2,000 a year) for each of your children to help with the costs of childcare. This goes up to £1,000 every 3 months if a child is disabled (up to £4,000 a year).

Tax-free Childcare Sign In

If you’ve already registered, you can sign in to your childcare account here.

If you get tax-free childcare, you’ll set up an online childcare account for your child. For every £8 you pay into this account, the government will pay £2 to use to pay your provider.

You can get tax-free childcare at the same time as 30 hours free childcare if you’re eligible for both.

Who Qualifies for Tax-free Childcare?

Your eligibility depends on:

- – if you are working

- – your income (and your partner’s income, if you have one)

- – your child’s age and circumstances

- – your immigration status

If you are working

You can usually get tax-free childcare if you (and your partner, if you have one) are:

- – in work

- – on sick leave or annual leave

- – on shared parental, maternity, paternity or adoption leave

If you’re on adoption leave, you cannot apply for the child you’re on leave for unless you’re going back to work within 31 days of the date you first applied.

Your child

Your child must be 11 or under and usually live with you. They stop being eligible on 1 September after their 11th birthday.

Adopted children are eligible, but foster children are not.

If your child is disabled you may get up to £4,000 a year until they’re 17. They’re eligible for this if they:

- – get Disability Living Allowance, Personal Independence Payment or Armed Forces Independence Payment

- – are certified as blind or severely sight-impaired

Your immigration status

To be eligible for tax-free childcare, you (or your partner if you have one) must have a National Insurance number and at least one of the following:

- – British or Irish citizenship

- – settled or pre-settled status, or you have applied and you’re waiting for a decision

- – permission to access public funds – your UK residence card will tell you if you cannot do this

If you’re living in an EU country, Switzerland, Norway, Iceland or Liechtenstein, you (or your partner if you have one) might still be eligible for tax-free childcare if:

- – your work is in the UK

- – the work started before 1 January 2021

- – you’ve worked in the UK at least once every 12 months since you started working here

Childcare vouchers

You must tell your employer within 90 days of applying for Tax-Free Childcare to stop your childcare vouchers or directly contracted childcare. They’ll then stop giving you new vouchers or directly contracted childcare.

You will have to give HMRC evidence you‘ve left your employer’s childcare voucher scheme, for example:

- – a copy of the letter telling your employer you’re leaving the childcare voucher scheme

- – copies of your payslips showing your pay before and after you’ve left the scheme

How to Apply for Tax-free Childcare

You may apply online for tax-free childcare here.

If you apply for tax-free childcare and someone else already gets 30 hours free childcare for that child, their 30 hours will stop at the end of the next term. You will be eligible for 30 hours of free childcare instead.

If you have a partner

You must include your partner in your application if you are:

- – married or in a civil partnership and live together

- – not married or in a civil partnership, but living together as though you are

Their employment and income will not affect your eligibility if they:

- – are or will be absent from your household for more than 6 months

- – are a prisoner

You and your partner cannot both have accounts for the same child.

If you are separated

You and your ex-partner need to decide who should apply if you are jointly responsible for your child.

If you cannot decide, both of you must apply separately and HMRC will decide who gets a childcare account.

How can MCL Accountants help?

Contact MCL Accountants Southend on 01702 593 029 if you have any queries regarding tax-free childcare or if you need any assistance with the preparation and submission of your company accounts or self-assessment tax returns to HMRC.

0 Comments