Uncategorized

How to Raise Money via the Enterprise Investment Scheme (EIS)

Published on 02/07/2022Enterprise Investment Scheme (EIS) is one of 4 venture capital schemes that can be used to raise money by a company. Click through to learn more!

Read More

Full Customs Controls – Get Ready for Changes from 1 January 2022

Published on 11/12/2021Full customs controls will be introduced from 1 January 2022 and HMRC have contacted traders reminding them to prepare accordingly.

Read More

Hidden tax risks of raiding the pension pot

Published on 04/07/2020Extracting cash from your pension might seem an obvious source of income during the Covid-19…

Read More

Reduced VAT rate for empty home

Published on 27/06/2020Q&A: reduced VAT rate for empty home conditions Q. My clients, a couple in their early…

Read More

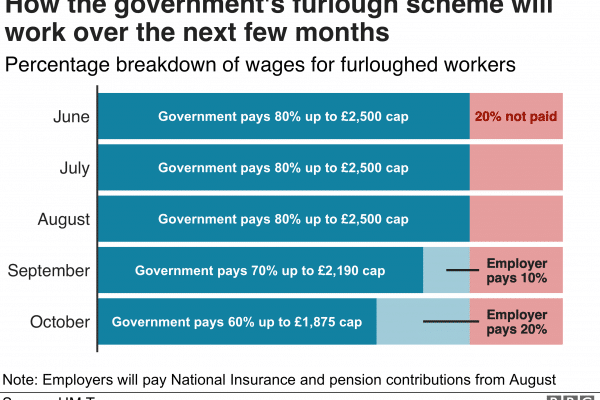

Part time Furloughing

Published on 30/05/2020Coronavirus Job Retention Scheme The Chancellor has announced three changes to the job retention scheme:…

Read More

£500m Future Fund launches & Self assessment payment deferrals

Published on 23/05/2020The government’s £500m Future Fund is open for applications, a month after the scheme to…

Read More

Job Retention Scheme extended until the end of October

Published on 16/05/2020The government’s Coronavirus Job Retention Scheme has been extended until the end of October Job…

Read More

Claim a grant through the Self-Employment Income Support Scheme

Published on 09/05/2020If you’re self-employed or a member of a partnership and have been adversely affected by…

Read More

Bounce Back Loan scheme

Published on 02/05/2020The Bounce Back Loan scheme will help small and medium-sized businesses to borrow between £2,000…

Read More

Step by Step guide to claim for forloughed staff wages

Published on 18/04/2020This step by step guide to claim for forloughed staff wages will take you through…

Read More