Tapered Annual Allowance: Threshold & Adjusted Income

26/06/2021 - 6 minutes readPensions and tapering is a question that is frequently asked by our clients, here’s a typical example:

I have a client that has taxable income for the tax year ended 5th April 2021 of £230,000 of which rental income is around £23,000 and attracts relief for the mortgage interest payments. Their employer has made a £15,000 contribution and they have also made a personal contribution of £15,000. Would they get caught by the tapering of the annual allowance charge?

What is the Pension Annual Allowance (AA)?

The annual allowance is a limit on the amount that can be contributed to your pension each year, while still receiving tax relief. It’s based on your earnings for the year and is capped at £40,000 (with the exception for 2015-16 that had transitional rules please see PTM057100).

What is the Tapered Annual Allowance (TAA)?

The tapered annual allowance (TAA) was introduced on 6 April 2016 for high earners and legislation can be found in FA 2004 S228ZA.

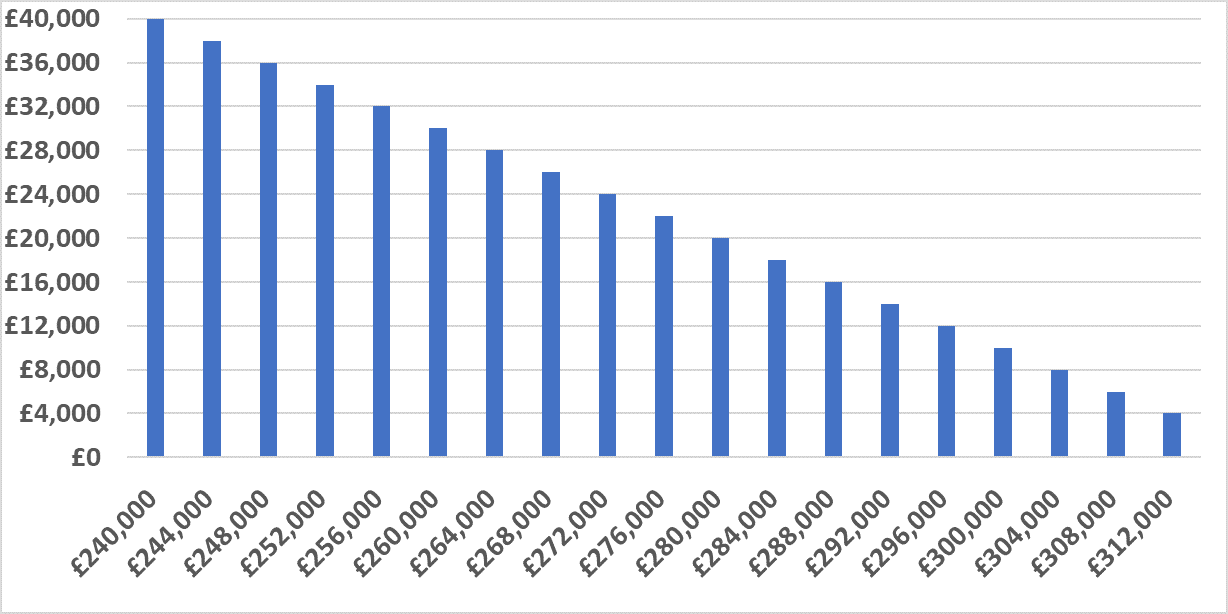

The tapered annual allowance is lower than the standard annual allowance. This lower limit may apply to any member, based on their level of taxable income within the tax year. For every £2 of ‘adjusted income’ above the limit, £1 of annual allowance will be lost. Please see the table below for the limits:

| - | Adjusted Income | Threshold Income | Minimum Annual Allowance |

|---|---|---|---|

| 5 April 2016 to 5 April 2020 | £150,000 | £110,000 | £10,000 |

| From 6 April 2020 | £240,000 | £200,000 | £4,000 |

You will note that as of 6 April 2020, the limits were increased. For every £2 of ‘adjusted income’ above £240,000, £1 of annual allowance will be lost. The maximum reduction was £36,000 meaning that anyone earning over £310,000 had their annual allowance is capped at £4,000.

What is Net Income?

When looking at the TAA the legislation FA 2004 S228ZA, it refers to the net income in step 1 & 2 of ITA 2007 s23.

Net income is taxable income less deductions. A full list of the deductions can be found at s.24 ITA 2007. However, care needs to be taken regarding the 20% tax deduction given for loan interest relief as this is step 6 of ITA 2003 S23 and therefore is not accounted for.

HMRC guidance PTM057100 provides a breakdown on how to calculate the threshold income and adjusted income but legislation reference is FA 2004 S228ZA.

How the Taper Works

Where both the adjusted income and threshold income have been breached then the rate of reduction in the annual allowance is by £1 for every £2 that the adjusted income exceeds £240,000, up to a maximum reduction of £36,000, down to a minimum tapered annual allowance of £4,000.

This results in the standard Annual Allowance being available for those with an adjusted income of less than £240,000; a reducing Annual Allowance for those with adjusted incomes between £240,000 and £312,000 and an Annual Allowance of £4,000 for those with an adjusted income over £312,000.

| - | Adjusted income | Threshold income |

|---|---|---|

| Taxable income | £230,000 | £230,000 |

| Add employers’ contributions | £15,000 | - |

| Less: gross members contributions | - | -£15,000 |

| Add Employment income via salary exchange | - | £0 |

| Less: Lump Sum Death Benefits | £0 | £0 |

| Adjusted income/threshold income | £245,000 | £215,000 |

Pensions and Tapering

(£245,000-£240,000): 5,000/2 = £2,500

Annual allowance 2020/21: £40,000-£2,500-=£37,500 reduced annual allowance for the year

Other areas you may wish to consider

- – PTM055100 – Individuals can carry forward annual allowance they have not been utilised on a FIFO basis for the last 3 years. If TAA restrictions apply, the taxpayer may have carried forward provisions to fall back on.

- – Net relevant earnings – Tax relief on pension contributions made by an individual into a qualifying pension scheme is limited to the higher of 100% of their relevant UK earnings or £3,600 per annum. HMRC guidance PTM044100.

- – Interaction with tapering annual allowance and the money purchase annual allowance – PTM057100

- – Remember for defined benefit schemes you calculate the contributions differently see PTM053301

Anti-avoidance Rules

Anti-avoidance rules were put in place to stop people from entering into a salary exchange or flexible remuneration arrangement after 8 July 2015 so they could receive additional pension contributions, but reduce their adjusted or threshold income.

The anti-avoidance rules apply if:

- – it’s reasonable to assume that the main purpose, or one of the main purposes, is to reduce the amount of their reduction under the tapered annual allowance for the current tax year, or two or more tax years which include the current tax year

- – they involve reducing adjusted income or threshold income for the tax year (or both)

- – they involve any of the reductions above, being cancelled out by an increase in the adjusted income, or threshold income, for a different tax year

If the anti-avoidance rules apply, the income used to calculate the reduction to the annual allowance for that tax year is the income before any adjustments were made.

How can MCL Accountants help?

Contact MCL Accountants on 01702 593 029 if you have any queries regarding pensions and tapering or if you need any assistance with the preparation and submission of your company accounts or self-assessment tax returns to HMRC.

Tags: Pension

0 Comments