130% Super-deduction Capital Allowance on Leased Assets

22/05/2021 - 5 minutes readSuper-deduction capital allowance plans announced in the March Budget are being extended to amend the qualifying criteria for the rules to include leased properties as per the latest government plans.

The amendments have been set out in Finance Bill clause 9 and will enable background plant and machinery in leased buildings to qualify for a super-deduction or an SR allowance.

For expenditure incurred from 1 April 2021 until the end of March 2023, companies can claim 130% capital allowances on qualifying plant and machinery investments.

Plant and Machinery & Capital Allowance

Most tangible capital assets used in the course of a business are considered plant and machinery for the purposes of claiming capital allowances.

There is not an exhaustive list of plant and machinery assets. The kinds of assets which may qualify for either the super-deduction or the 50% FYA include, but are not limited to:

• Solar panels

• Computer equipment and servers

• Tractors, lorries, vans

• Ladders, drills, cranes

• Office chairs and desks,

• Electric vehicle charge points

• Refrigeration units

• Compressors

• Foundry equipment

Under the super-deduction, for every pound a company invests, their taxes are cut by up to 25p.

FINANCE (NO.2) BILL 2019-21 CLAUSE 9

New subsection 8A ensures that property lessors are not prohibited by the general exclusion on plant and machinery for leasing from claiming the super-deduction and SR allowance in respect of expenditure on background plant or machinery for a building (as defined in section 70R of the Capital Allowances Act 2001).

These reliefs are only available for companies within the charge to corporation tax. Unincorporated businesses can claim the full cost of expenditure through the Annual Investment Allowance, up to the relevant limit.

An update from the ICAEW tax faculty explained:

‘This will ensure that the allowances are available where a company purchases or constructs a building and fits it out with fixtures and other assets that contribute to the functionality of the building, or its site, as an environment in which commercial activities can be carried out. Such assets were previously excluded from attracting these allowances owing to the general exclusion of leased assets.’

ICAEW called for an extension of these allowances to leased assets in its ICAEW REP 35/21 and pointed out the complexity that the rules would cause, as originally drafted, in cases where buildings are purchased or constructed and parts of them are fitted and leased out (eg, shopping centres, offices and industrial spaces with individual leased units and university accommodation). In such cases, fixtures and other assets in all parts of these buildings will now qualify for the allowances.

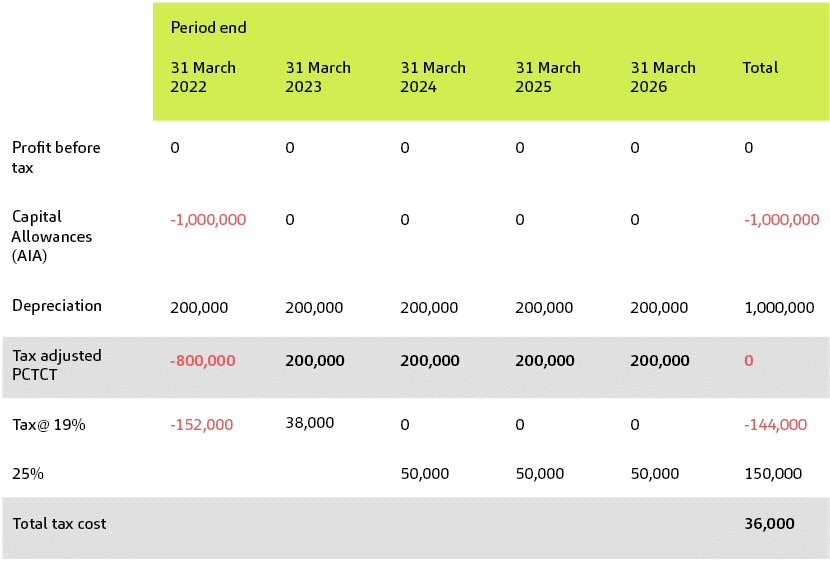

Capital allowances allow the cost of capital assets to be written down against a business’s taxable profits. They are available in place of commercial depreciation provided for in commercial accounts. The main rate of writing down allowance for the main rate plant and machinery is 18% a year on a reducing balance basis.

The special rate of capital allowances, which applies to certain spending on plant and machinery including integral features, long-life assets, thermal insulation, is 6% a year on a reducing balance basis.

The super-deduction is a 130% first-year allowance for qualifying plant and machinery expenditure which would ordinarily be relieved at the main rate writing down allowance at 18%. The 50% special rate first-year allowance provides relief for qualifying expenditure that would ordinarily be relieved at the special rate writing down allowance.

The 130% super deduction is available for two years for qualifying companies. There are exclusions to these reliefs, which include expenditure on cars, second-hand assets, and connected party transactions (as per existing legislation for first-year allowances in Chapter 17, Part 2 CAA 2001).

Need help with Super-deduction criteria?

Contact MCL Accountants on 01702 593 029 to optimise your tax position or if you need any assistance with your company accounts or more information about the Super-deduction criteria.

0 Comments