Spring Statement 2022: Key Points – Winners & Losers

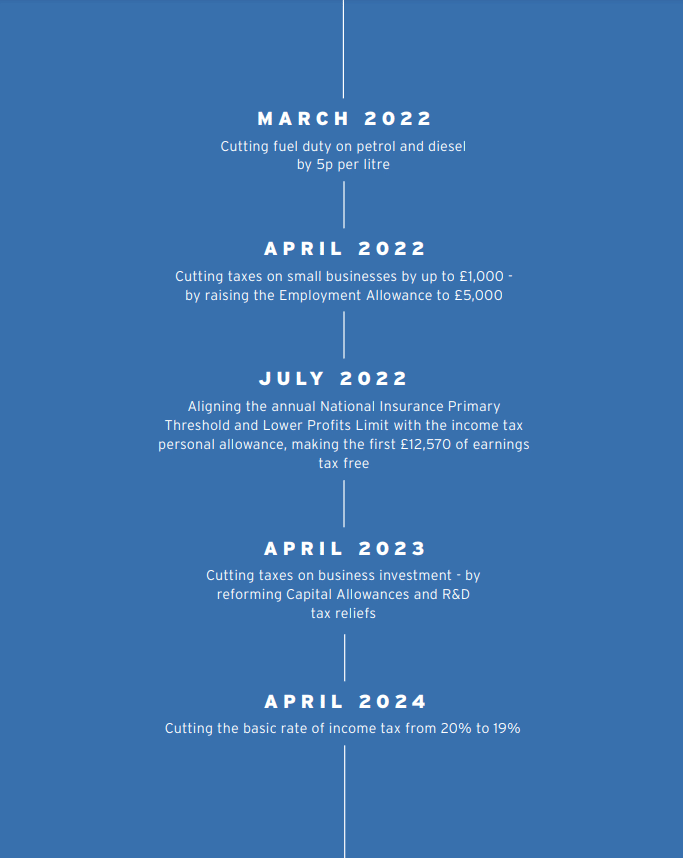

26/03/2022 - 7 minutes readChancellor Rishi Sunak unveiled the contents of his Spring Statement in the House of Commons earlier this week with some good news for employees who have been hard hit by the rising inflation.

INCREASING NATIONAL INSURANCE THRESHOLDS

In a move to give taxpayers some respite from the cost of living crisis, Chancellor Rishi Sunak announced plans to raise the national insurance threshold by £2,690.

The threshold will increase by £2,690 from the current £9,880 to £12,570 from 6 July 2022, equalising the NICs and income tax thresholds for the first time, and potentially pointing towards a merger of income tax and NICs into a single threshold.

Sunak said: ‘The current threshold for national insurance is £9,500 and I will increase this by £3,000 – equalising the NICs and income tax thresholds from July 2022. This is a £6bn tax cut for 30m people and is the largest increase in the basic rate threshold ever. It is a tax cut that rewards work.’

The rise in the threshold will cut tax by an average of £330 per worker and will effectively balance out the new social care levy for employees which comes into effect from 6 April. The total saving for the 2022-23 tax year will be £267.

The government is also taking steps to ensure that self-employed individuals with lower earnings fully benefit. From April 2022 self-employed individuals with profits between the Small Profits Threshold and Lower Profits Limit will continue to build up National Insurance credits but will not pay any Class 2 NICs.

This measure will increase the Primary Threshold (PT) for Class 1 NICs and Lower Profits Limit (LPL) for Class 4 NICs from 6 July 2022, aligning it with the personal allowance for income tax, which is set at £12,570 per year. The rate will remain until the tax year 2025-26. From the tax year 2026-27 onwards, the PT and LPL will follow the default position of being increased in line with the Consumer Price Index (CPI). Further details are available here.

INCREASING THE EMPLOYMENT ALLOWANCE BY 20%

In a bid to support businesses, the Chancellor announced a 20% rise in the employment allowance from the new tax year.

This measure will increase the employment allowance by £1,000, from £4,000 to £5,000. This will come into effect from 6 April 2022.

Eligible employers are those who have secondary Class 1 National Insurance contributions (NICs), and additionally from the 2024 to 2025 tax year onwards health and social care levy liabilities of under £100,000 in the previous tax year.

As a result, businesses will be able to employ four full-time employees on the national living wage without paying employer NICs. This measure will benefit around 495,000 businesses, including around 50,000 businesses which will be taken out of paying NICs and the health and social care levy entirely.

In total, this means that from April 2022, 670,000 businesses will not pay NICs and the health and social care levy due to the employment allowance.

CUTTING INCOME TAX FROM 20% TO 19%

In the Spring Statement, the Chancellor announced long-term plans to cut the basic rate of income tax from 20% to 19% in 2024.

Chancellor Rishi Sunak stated that the tax cut will affect 30m people applying to the basic rate which applies to employment income and non-savings, non-dividend income for taxpayers in England, Wales, and Northern Ireland.

There will also be a three-year transition period for Gift Aid relief to maintain the income tax basic rate relief at 20% until April 2027. This will affect almost 70,000 charities and is worth around £300m.

The 1p cut to income tax is set to cut tax by £5.3bn in 2024-25, by £6bn in 2025-26, and by £5.9bn in 2026-27.

In the Spring Statement, the Chancellor said that this is the first cut in the basic rate of income tax since 2008-09.

The Spring Statement documents state that the change will be implemented in a future Finance Bill ‘provided that the fiscal principles set out above are met in future. The government will confirm plans for reforms to reliefs and allowances ahead of implementation.’

ZERO RATE VAT FOR SOLAR PANELS

Addressing the energy crisis, the Chancellor set out plans to remove VAT from investment in solar panels and heat pumps but stopped short of offering grants.

Chancellor Rishi Sunak said: ‘As energy costs rise, for next five years homeowners having solar panels and heat pumps installed will pay zero rate VAT, and there will be a zero rate for investment in wind and water turbines.’

To help households improve energy efficiency and keep heating bills down, the government will expand the scope of VAT relief available for energy-saving materials including solar panels and wind turbines, so that households having energy-saving materials installed pay 0% VAT. The current rate is 5%.

The zero rate VAT scheme will start on 1 April and will run until March 2027.

A typical family having rooftop solar panels installed will save more than £1,000 in total on installation, and then £300 annually on their energy bills. The changes will take effect from April 2022.

It also brings wind and water turbines into the scope of the relief, previously excluded from the discounted VAT rate.

SPRING STATEMENT 2022 IN FULL (Video)

Spring Statement 2022 – How can MCL Accountants help?

Contact MCL Accountants on 01702 593 029 if you have any queries on the announcements made by the Chancellor in the Spring Statement 2022 or if you need any assistance with the preparation and submission of your business accounts or self-assessment tax returns to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments