NI Rate Cut for Employees & Self-Employed

25/11/2023 - 6 minutes readNI Rate cut for Employees & Self-Employed was announced in the Autumn Budget 2023.

NI Rate Cut for Employees

NI Rate cut for Employees will be effective from 06th Jan 2024 with employees gaining from a reduction of the main rate of employee Class 1 National Insurance contributions by 2 percentage points from 12% to 10% from 6 January 2024.

- – The main rate of Employee NICs will be 10% from 6 January 2024.

- – Employees will benefit from January, as their employers make changes to their payroll system.

- – There may be a minority of employers who do not amend their payroll system in time for employees to see the benefit in their January payslip. Employers will rectify this in subsequent months and employees will receive the full value of the NICs cut.

- – The Lower Earnings Limit – the point at which employees start to receive NI credits – has been frozen at £6,396, in line with last year’s approach. This supports low income working individuals by maintaining their access to NICs credits, without having to pay NICs.

- – Individuals will continue to be able to pay voluntary Class 3 NICs to help fill gaps in their National Insurance record to qualify for the State pension, exactly as before. The Class 3 rate will also be frozen at £17.45 per week for 2024-25.

NI Rate Cut for Self-Employed

NI Rate cut for self-employed will reduce the main rate of Class 4 National Insurance contributions by 1 percentage point, from 9% to 8%, and remove liability to pay the weekly Class 2 flat rate for those with profits above £12,570 from 6 April 2024, while ensuring they will retain access to contributory benefits including the State Pension (as is currently the case).

Those with profits under £6,725, who pay Class 2 National Insurance contributions voluntarily, will also retain access to contributory benefits including the State Pension.

NI Rate cut for Employees & Self-Employed impacts the main rate of National Insurance contributions paid by employees over the Primary Class 1 threshold, and to reduce the main rate of Class 4 National Insurance contributions paid by those liable to pay Class 4 National Insurance contributions, and to remove liability to pay Class 2 National Insurance contributions.

Individuals who can currently pay Class 2 National Insurance contributions voluntarily will still be able to do so.

These changes deliver a tax cut for working people and simplify the tax system by removing the liability for self-employed people to pay Class 2 National Insurance contributions.

Proposed revisions to Company Directors NI rate

NI rate cut will result in a blended rate 11.5% of Class 1 National Insurance contributions to the Annual Earnings Period for directors for tax year 2023 to 2024 where the earnings period is as specified in regulation 8(2) to (5) of the Social Security (Contributions) Regulations 2001.

A blended rate approach has been adopted for in-year changes where appropriate, when National Insurance contributions liability is assessed on an annual basis. The blended rate will apply from the start of the 2023 to 2024 tax year, but has been set at a level such that its effect is equivalent across the tax year to the rate cut received by those who are employed and paid on a weekly or monthly basis.

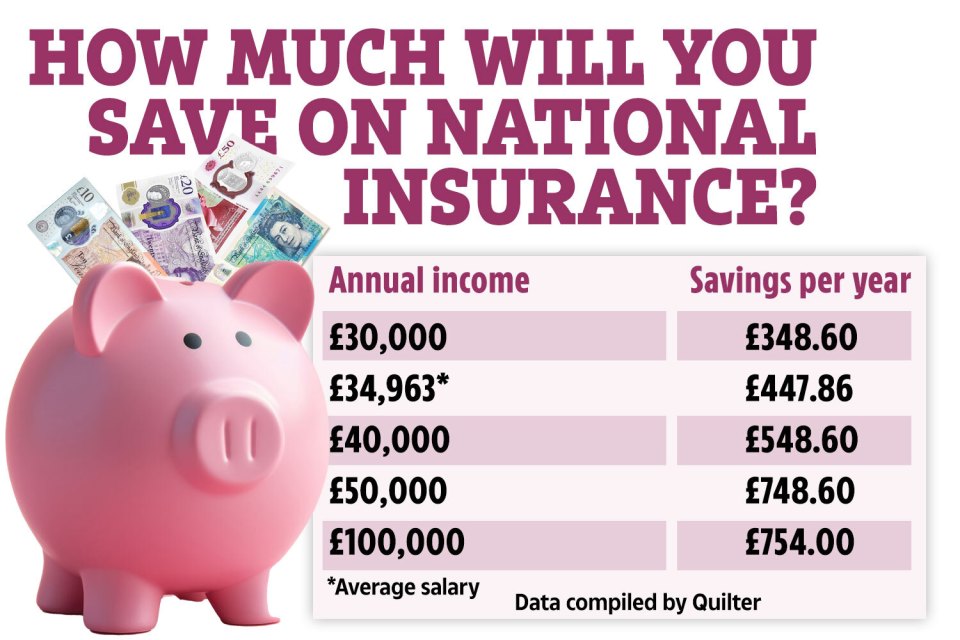

NI Rate Cut – Who does this help?

The government has produced some examples of who does this NI rate cut help:

- – A senior nurse with 5 years of experience on £42,618 will receive an annual gain of £600.[footnote 2]

- – An average full-time nurse on £38,900 will receive an annual gain of over £520.[footnote 3]

- – An average police officer on £44,300 will receive an annual gain of over £630.[footnote 4]

- – A typical junior doctor on £63,000 will receive an annual gain of over £750.[footnote 5]

- – A cleaner working night shifts on £21,000 will receive a gain of £170.[footnote 6]

- – A typical self-employed plumber on £34,400 will receive an annual gain of £410.[footnote 7]

- – An average teacher on £44,300 will receive an annual gain of over £630.[footnote 8]

- – A hard-working family with 2 earners on the average earnings of £35,404 will be £900 better off.

Key National Insurance Rates and Thresholds from 6 April 2024

| NICs Primary Threshold / Lower Profits Limit | £12,570 (annual) |

| Class 1 NICs Main Rate (from 6 January 2024) | 10% |

| Class 4 NICs Main Rate | 8% |

| Lower Earnings Limit | £6,396 (annual) |

| Small Profits Threshold | £6,725 (annual) |

| Class 2 Rate (for those paying voluntarily) | £3.45 (per week) |

| Class 3 Rate | £17.45 (per week) |

How can MCL Accountants help with your queries on NI rate cut?

Contact MCL Accountants on 01702 593 029 if you have any queries on NI Rate Cuts or if you need any assistance with the preparation and submission of your business accounts or self-assessment tax returns to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments