Letter from HMRC About Undeclared Dividend Payments

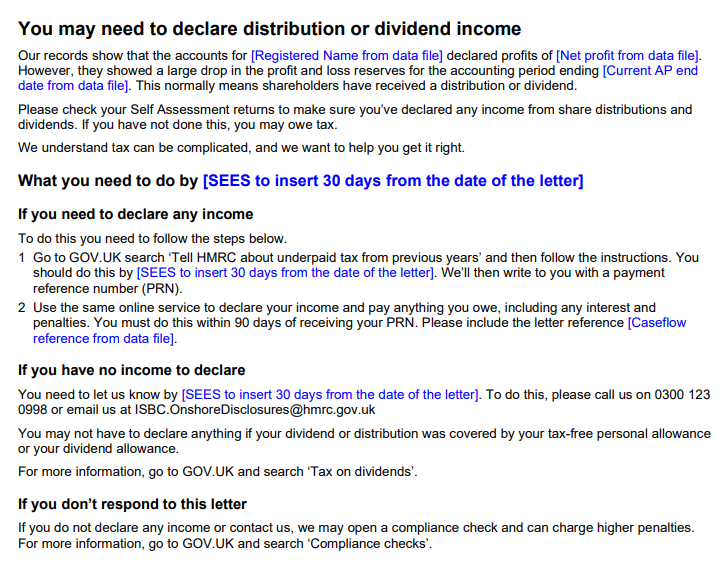

10/02/2024 - 5 minutes readLetter from HMRC about undeclared dividend payments has been received by business owners in the last week notifying them about the potential requirement to declare their dividend income.

Letter from HMRC about undeclared dividend payments is a result of HMRC conducting investigations into company reserves and writing to the company owners whereby the company has recorded a profit for the year but their profit & loss account reserves have depleted which raises the possibility of a dividend payment made by the company.

Letter from HMRC about undeclared dividend payments gives the company owners a choice to disclose any undeclared dividends or to inform HMRC if they believe there are no dividends to be declared on their self-assessment tax returns.

Dividends

A dividend is a payment a company can make to shareholders if it has made a profit.

You cannot count dividends as business costs when you work out your Corporation Tax.

Your company must not pay out more in dividends than its available profits from current and previous financial years.

You must usually pay dividends to all shareholders.

To pay a dividend, you must:

- – hold a directors’ meeting to ‘declare’ the dividend

- – keep minutes of the meeting, even if you’re the only director

Dividend paperwork

For each dividend payment the company makes, you must write up a dividend voucher showing the:

- – date

- – company name

- – names of the shareholders being paid a dividend

- – amount of the dividend

You must give a copy of the voucher to recipients of the dividend and keep a copy for your company’s records.

Tax on dividends

Your company does not need to pay tax on dividend payments. But shareholders may have to pay Income Tax if they’re over £1,000.

Tax-free dividend allowance will be reduced further to £500 from 6 April 2024 onwards.

Dividend income from assets held in ISAs will remain completely tax-free.

Directors’ loans

If you take more money out of a company than you’ve put in – and it’s not salary or dividend – it’s called a ‘directors’ loan’.

If your company makes directors’ loans, you must keep records of them. There are also some detailed tax rules about how directors’ loans are handled.

Disclose any undeclared dividend payments

If you check your company accounts and find undeclared dividend payments, you’ll need to tell HMRC by making a disclosure. You can do this through HMRC’s disclosure service.

When you register for the facility, you ‘notify HMRC of your intent to disclose’. You’ll have 90 days to make your disclosure from the date you register.

What you will need

To make a disclosure, you need a Government Gateway user ID and password. If you do not have a user ID you can create one when you first use the service.

If you have one, you will also need your:

- – National Insurance number

- – VAT registration number

- – Unique Taxpayer Reference (UTR)

- – case reference number

Make a disclosure

There is a 90-day deadline after receipt of the PRN; if this is not met HMRC can open a compliance check and charge higher penalties if undeclared dividend payments are found.

How can MCL Accountants help with your queries on Letter from Hmrc about undeclared dividend payments?

Contact MCL Accountants on 01702 593 029 if you would like us to answer your queries on Letter from Hmrc about undeclared dividend payments or if you need any assistance with the preparation and submission of your business accounts or self-assessment tax returns to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments