Annual Share Plan Return – Filing Deadline is 6th July

20/05/2023 - 6 minutes readAnnual share plan return for the tax year 2022/23, commonly referred to as employment-related securities (ERS) return needs to be submitted to HMRC before 6th July to avoid a late filing penalty.

HMRC does not send reminders to file annual share plan returns (ERS returns), but they will issue automatic penalties.

If annual ERS returns have not been filed for each open scheme by 6 July following the end of the tax year, HMRC can levy automatic late filing penalties (starting at £100 per scheme).

Annual share plan returns have to be completed by UK directors, employees or employees with UK work duties who have acquired shares or other securities in their company; or if their company operates an employee share plan or arrangement.

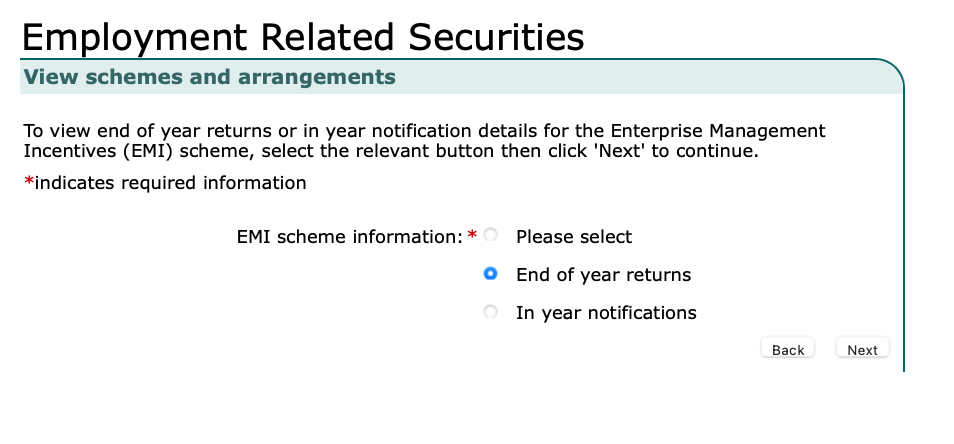

You need to tell HMRC about your ERS scheme before you can submit an annual share plan return.

Annual share plan returns (ERS Returns) are required to report events relating to securities (such as options, shares or loan notes) which involve employees and/or directors (including founding directors).

A company must ensure it has registered its share schemes and ERS events properly online via the HMRC PAYE portal.

Any scheme registered online will require annual returns to be filed for subsequent tax years, irrespective of whether there have been any reportable events in those tax years unless the scheme has been formally closed by entering a ‘date of final event.’

The events and transactions that can be classified as employment-related securities are wide-reaching and the ERS rules can apply even if there is no formal employee share plan.

This could include (but is not limited to):

- – HMRC tax-advantaged plans (EMI, CSOP, SAYE/Sharesave and SIP);

- – share acquisitions and disposals;

- – share options;

- – share-for-share exchanges;

- – overseas plans with UK participants (e.g. RSUs, RSAs and ESPPs);

- – group re-organisations and other corporate transactions;

- – variations in share capital;

- – carried interest arrangements;

- – the lifting of restrictions attached to shares (including on disposal);

- – restricted stock units (RSUs) and restricted stock awards (RSAs);

- – transactions involving loan notes or warrants; and

- – units in investment schemes.

When to submit your return

You must submit your return by 6 July following the end of the tax year, or you may have to pay a penalty.

You need to submit an annual share plan return (ERS return) even if:

- – there have been no transactions

- – you have appealed a late filing penalty

- – the scheme has been registered in error or there’s a duplicate scheme

- – you did not get a reminder from HMRC

If your ERS scheme has ceased and you have entered a final event date, you must submit any outstanding returns up until the date of cessation.

Failure to register a CSOP, SIP or SAYE scheme online by 6 July following the tax year in which the first awards were granted will result in any awards granted in that previous tax year not qualifying for the associated tax reliefs;

Failure to notify HMRC of the grant of EMI options within 92 days from each grant date will also result in any awards granted to not qualify for the associated tax reliefs

To submit an Annual share plan return (ERS Return), you’ll need to:

- – Download and fill in the relevant template.

- – Upload the template. You’ll need the Government Gateway user ID and password you used when you told HMRC about the scheme.

How to Submit a nil return?

If you have nothing to report, you must submit a nil return.

To submit your nil return, you’ll need the Government Gateway user ID and password you used when you told HMRC about the scheme.

How can MCL Accountants help?

Contact MCL Accountants on 01702 593 029 if you would like us to help with your annual share plan (ERS return) filing or if you need any assistance with the preparation and submission of your business accounts or self-assessment tax returns to HMRC.

- ABOUT

- REQUEST A QUOTE

Ishan provides financial management, taxation and transactional advice to business entities of all sizes. His expert areas include statutory compliance, business taxation, personal tax & transactional processing and systems. Industry sectors include professional services, retail, hospitality and entertaining & media and advertising services.

0 Comments