Tax

Reporting Letting Income: Letter From HMRC

Published on 20/02/2021Have you received a letter from HMRC for income from letting a property? If yes, please contact us to discuss your options and how we can help you.

Read More

COVID-19: New VAT Deferral Payment Scheme Opens on 23 February

Published on 13/02/2021Instead of paying the full amount by the end of March 2021, up to 11 smaller monthly instalments can be made, interest-free. Learn how to join!

Read More

Capital Gains Tax on Sale of Rental Property

Published on 06/02/2021Capital Gains Tax is payable on the sale of second homes & buy-to-let properties. Find out how to report & pay CGT on the sale of rental property.

Read More

Sending Goods to the EU After Brexit: Changes & Impact On The UK

Published on 23/01/2021With the Brexit transition period over and a deal in place, there are a few changes you need to be aware of when sending goods from the UK to Europe.

Read More

VAT Domestic Reverse Charge for Building and Construction Services

Published on 16/01/2021Find out about the VAT Domestic Reverse Charge for supplies of building and construction services from 1 March 2021.

Read More

£4.6bn in New Lockdown Grants to Support Businesses Through the Latest National Lockdown

Published on 09/01/20215 January 2021: Chancellor Rishi Sunak has announced £4.6 billion in new lockdown grants to help businesses through the latest national lockdown.

Read More

Coronavirus Job Retention Scheme Extended Until 30 April 2021

Published on 19/12/2020Coronavirus Job Retention Scheme (CJRS) extension: Chancellor Rishi Sunak has extended the furlough scheme for one month until the end of April 2021.

Read More

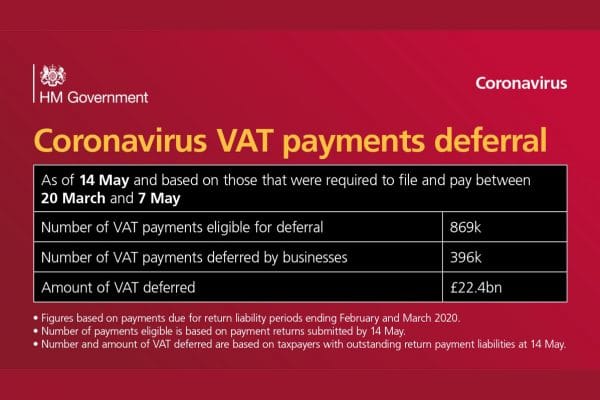

How to Pay Deferred VAT due to Coronavirus Crisis (COVID-19)

Published on 28/11/2020Businesses which deferred VAT due in March to June 2020, have the option to spread their payments over the financial year 2021/2022. How to apply.

Read More

Capital Gains Tax (CGT) Review & Indexation Allowance

Published on 21/11/2020Capital Gains Tax review may help landlords and second homeowners to cut their tax bills under new proposals for capital gains duties.

Read More

Worldwide Disclosure Facility (WDF): How to Settle Undisclosed Offshore Income, Gains or Assets

Published on 14/11/2020Learn how to use the Worldwide Disclosure Facility (WDF) to disclose a UK tax liability that relates wholly or in part to an offshore issue.

Read More