Tax

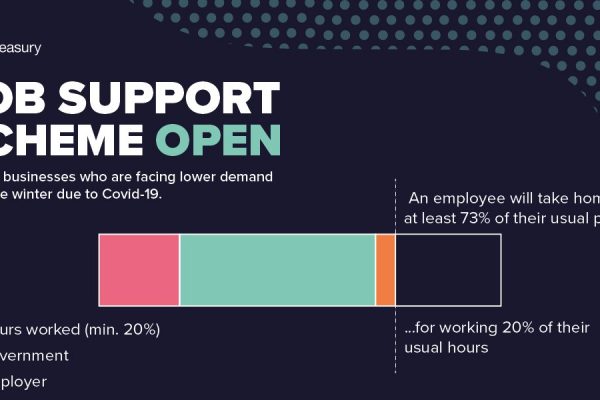

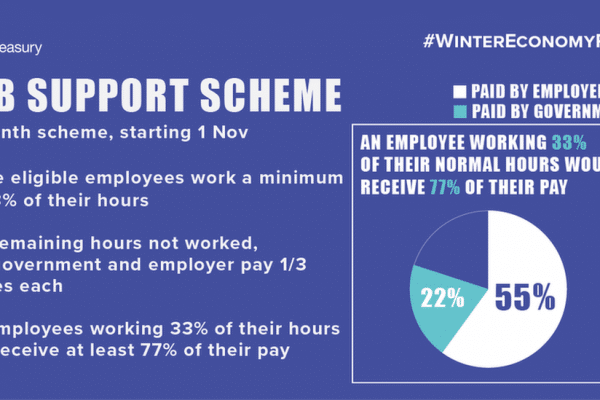

How Will JSS Open and JSS Closed Work | Job Support Scheme

Published on 31/10/2020JSS Open & JSS Closed (1st November 2020): Eligibility criteria, conditions and timescales for making claims under the Job Support Scheme.

Read More

Tax on Rental Income: How to Report your Taxable Profits

Published on 24/10/2020If you rent out a property, you’ll need to pay tax on any profit you make. Learn how to work out your taxable rental profit and how to report it to HMRC.

Read More

Airbnb Share Letting Data with HMRC

Published on 17/10/2020Landlords should realise that HMRC will know about their lettings through Airbnb, so full disclosure of all their taxable property income is essential.

Read More

Check If You Can Claim the Job Retention Bonus from 15 February 2021

Published on 10/10/2020Find out if you’re eligible to claim the Job Retention Bonus and what you need to do to claim it between 15 February 2021 and 31 March 2021.

Read More

10 Effective Ways to Claim Tax Relief for Small Businesses

Published on 03/10/2020From business rates to VAT relief, we’ve pulled together 10 tax reliefs small businesses can claim to help you work out if you can reduce your tax bill.

Read More

Chancellor Unveils New Job Support Scheme & Extends Self-employed Grant

Published on 24/09/2020Chancellor unveils new Job Support Scheme which will contribute to some employees’ wages and a limited extension of the Self-Employment Income Support Scheme.

Read More

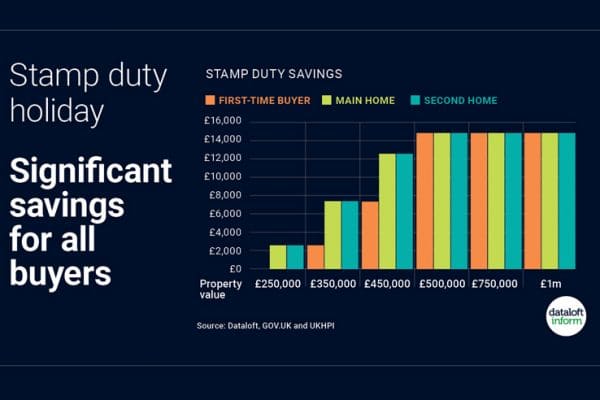

SDLT Holiday: Benefits for Buy-to-let Tenants in Common

Published on 12/09/2020The property market in England and Northern Ireland has now had a month to get…

Read More

Furlough Fraud: CJRS Post-transaction Review Phase Started

Published on 05/09/2020The first wave of compliance letters regarding CJRS was issued last week as HMRC moves into the post-transaction review phase of the scheme.

Read More

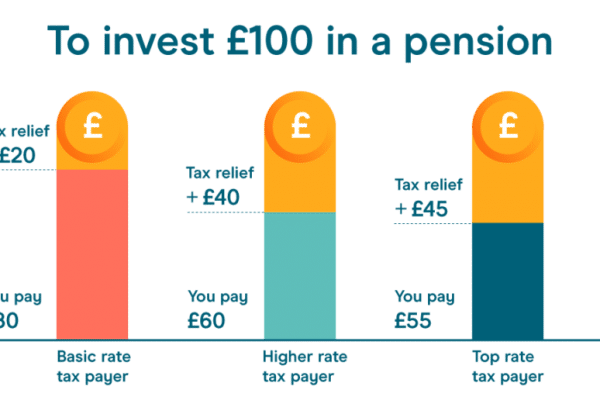

Higher rate pension relief threat to fund coronavirus bill

Published on 29/08/2020Latest Office for Budget Responsibility (OBR) estimates put the cost of Coronavirus government debt at…

Read More

Private Residence Relief

Published on 22/08/2020From 6 April 2020 the relief available on your disposal has changed. You would normally…

Read More