VAT

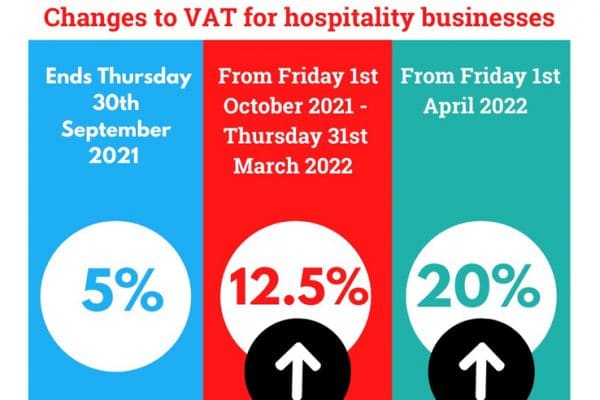

VAT Rate Increase from 1 October 2021

Published on 24/09/2021VAT rate increase from 1 October 2021 applies to hospitality businesses and the VAT rate…

Read More

Can you Recover VAT on Company Car? Your Questions Answered

Published on 18/09/2021Can you recover the VAT on the company car? This is a question that has been asked multiple times by employers providing their employees with a car.

Read More

VAT on Food in the UK: Standard & Zero-Rated VAT Items

Published on 12/06/2021Are you a VAT registered business looking to figure how VAT is applicable on your food items? Click through to find out more about the applicable rates.

Read More

New Penalty Rates for VAT Returns from April 2022

Published on 27/03/2021New penalty rates for VAT returns will come into effect for VAT return periods beginning on or after 1 April 2022. Click through to learn all about them.

Read More

Budget 2021: Furlough & Self-employed Support Extended

Published on 06/03/2021Budget 2021: Key points at-a-glance. The Chancellor of the Exchequer presented his Budget to Parliament on Wednesday 3 March 2021.

Read More

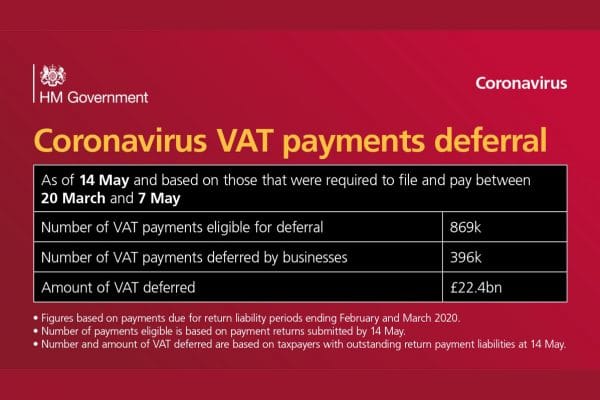

COVID-19: New VAT Deferral Payment Scheme Opens on 23 February

Published on 13/02/2021Instead of paying the full amount by the end of March 2021, up to 11 smaller monthly instalments can be made, interest-free. Learn how to join!

Read More

VAT Domestic Reverse Charge for Building and Construction Services

Published on 16/01/2021Find out about the VAT Domestic Reverse Charge for supplies of building and construction services from 1 March 2021.

Read More

How to Pay Deferred VAT due to Coronavirus Crisis (COVID-19)

Published on 28/11/2020Businesses which deferred VAT due in March to June 2020, have the option to spread their payments over the financial year 2021/2022. How to apply.

Read More

VAT after a “no deal” Brexit

Published on 26/09/2018What happens to VAT after a “no deal” Brexit Last month, the Department for Exiting…

Read More